Blog

Keep up with the pace of payments.

Retail

UK e-commerce payment trends: SME retailer guide

Discover the top UK e-commerce payment trends for 2025 and beyond. From mobile commerce to AI shopping, learn how SME retailers can adapt and grow their business.

FinTech

Fix failed subscription payments with tokenization | Ecommpay

Explore how network tokenization addresses failed subscription payments and how it can help businesses retain customers and maximise their lifetime value.

FinTech

Reducing subscription churn via intelligent recovery | Ecommpay

Reduce subscription churn with intelligent recovery techniques. Keep customers engaged and boost your revenue in the subscription economy.

FinTech

Switch payment providers without losing subscribers | Ecommpay

Seamlessly switch payment providers without losing subscribers. Learn how to migrate PSPs securely while ensuring uninterrupted service.

FinTech

A simple guide to card processing

Here are the basics of card processing - what it is, how it works, and what SMEs need to consider when choosing a solution

FinTech

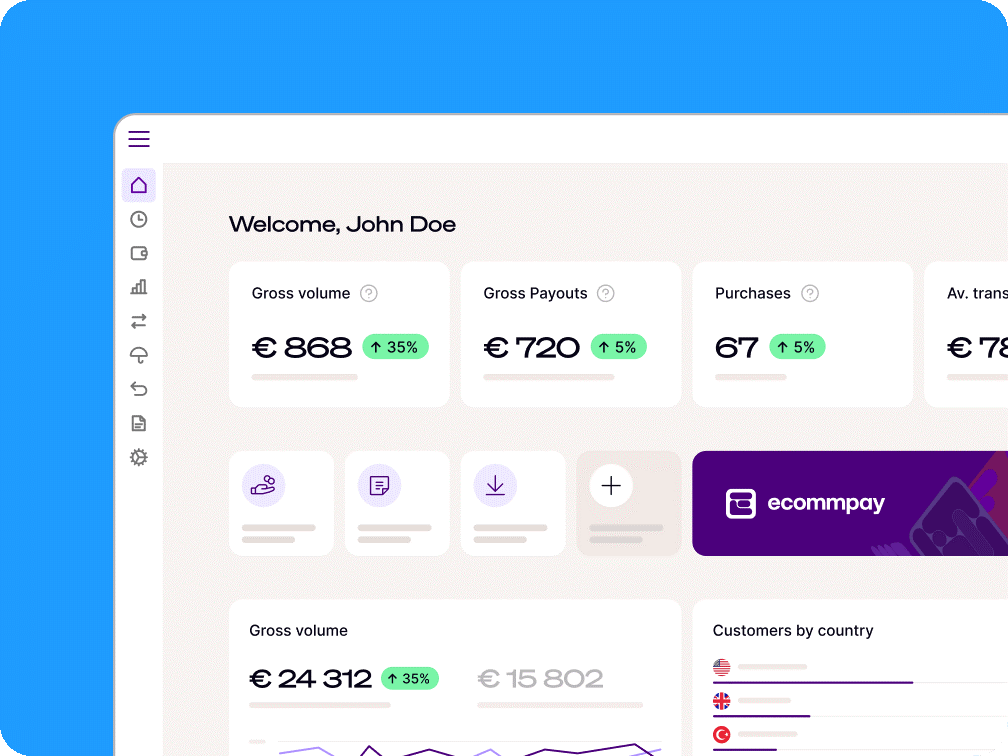

What is a payment dashboard & how can SMEs benefit from it?

Payment dashboards help SMEs track transactions, monitor performance, and manage cash flow more effectively. See how your business can benefit.

This page is being updated. Please check our LinkedIn page for latest news.