A beginner’s guide to e-commerce payments for small online retailers

Shoppers today expect a seamless checkout experience, no matter how they choose to pay. If the process is clunky, slow, or doesn’t feel secure, there’s a good chance they’ll abandon the purchase. Worse still, they may not ever come back.

It’s not just about collecting money - your payment setup affects customer trust, conversion rates, and even your ability to scale.

In this guide, we’ll cover everything you need to know to get started with e-commerce payments, from understanding how online payments work to selecting the right provider, a breakdown of the associated costs, and ensuring the security of your transactions.

Whether you’re launching your first store or refining an existing setup, these foundations will help you build a payment system that works for your business and your customers.

What are e-commerce payments?

An e-commerce payment is a digital transaction made over the internet in exchange for goods or services. Unlike in-person payments, e-commerce transactions don’t involve physical card readers (POS) or cash. Instead, the customer enters their payment details online, and the transaction is processed electronically.

Who’s involved in an online transaction?

Even a straightforward online payment passes through several service providers:

- The customer: Initiates the payment by entering their details at checkout.

- The merchant (you): Receives the funds (after fees) into your business account.

- The payment gateway: Captures and encrypts the payment information and sends it securely for processing.

- The payment processor: Handles communication between the acquirer and issuing bank to complete the transaction.

- The acquirer: Manages your merchant account and receives funds from the customer’s bank.

- The issuing bank: The customer’s bank, which approves or declines the transaction based on available funds and fraud checks.

Each party plays a role in ensuring the transaction is secure, authorised, and properly settled.

Protecting payment data

No matter how big or small an online business is, there are a number of regulations and standards that need to be adhered to that ensure that payment data is secure.

PCI DSS compliance

If you accept card payments, you’re responsible for meeting PCI DSS (Payment Card Industry Data Security Standard) requirements. Many providers help manage this for you.

Ignoring payment security requirements can have serious consequences for your business. Failing to comply with PCI DSS standards could result in fines, higher transaction fees, or even losing the ability to process card payments altogether.

Beyond the financial penalties, a data breach can severely damage customer trust and your reputation, which can be much harder to recover from.

GDPR compliance

If you operate in the UK or EU, GDPR (General Data Protection Regulation)also applies.

It requires businesses to handle personal data (including payment details) responsibly and transparently. Non-compliance can lead to hefty fines of up to £17.5 million or 4% of your global turnover, whichever is higher. More importantly, customers are increasingly aware of their rights and expect brands, both big and small, to take data privacy seriously.

Staying compliant isn’t just a box-ticking exercise - it’s about protecting your business and earning your customers’ trust. To help you do this, there are a number of fraud prevention tools available.

Fraud prevention tools

Fraud prevention tools help keep your business and your customers safe. The right tools can spot suspicious activity, stop fraudulent payments, and reduce the risk of costly chargebacks, all while keeping checkout frictionless for genuine customers.

Fraud prevention tools reduce risk and protect your revenue, such as:

- 3D Secure 2.0 adds an authentication step.

- Address Verification (AVS) and CVV checks confirm the cardholder’s details.

- Fraud scoring tools help detect unusual patterns and flag suspicious transactions.

Managing chargebacks

A chargeback occurs when a customer disputes a payment. To minimise them:

- Be clear with refund policies.

- Use tracking for deliveries.

- Respond quickly to disputes.

Most payment providers will provide a suite of risk management tools that help monitor transactions to detect fraud, reduce risk, and ensure regulatory compliance.

Customer experience matters

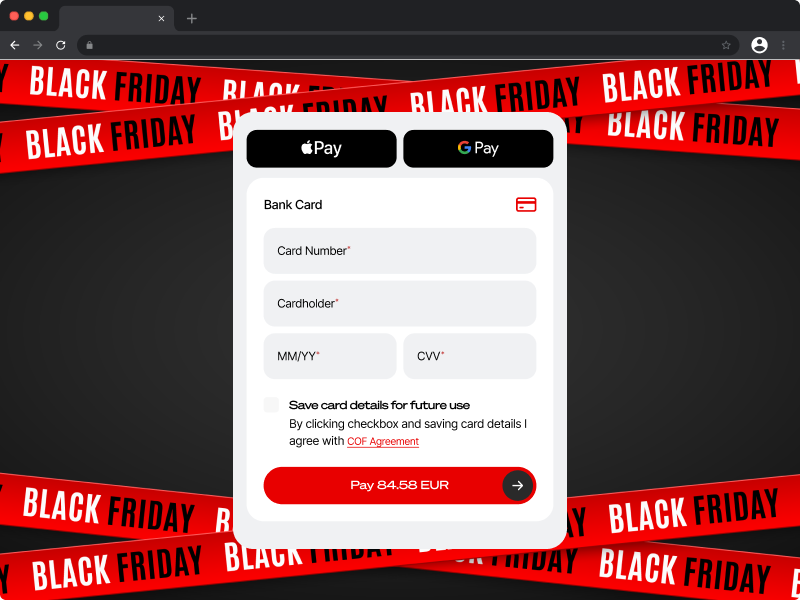

A smooth, simple checkout can make the difference between a sale and an abandoned basket. Customers want to complete transactions quickly, and any delay in the checkout process can increase the chance of cart abandonment. The easier it is for customers to pay, the more likely they are to complete their purchase.

When designing a checkout, consider:

- Offering guest checkout.

- Minimising form fields.

- Optimising for mobile.

- Displaying trust badges.

Customers also want to pay using their preferred method. If your checkout doesn’t support their preferred method, they’re more likely to abandon their basket and head elsewhere. By giving customers choice and convenience, you remove friction and make it easier for them to complete their purchase.

What are the most common e-commerce payment methods in the UK?

In the UK, debit cards are still the most widely used payment method, making up just over half of all transactions. Digital wallets are gaining serious traction: 40% of UK consumers used one to make an online purchase in 2024. This shift is largely driven by younger shoppers, especially Gen Z, who have grown up with smartphones and expect payments to be fast, secure, and seamless. Buy Now, Pay Later (BNPL) options are growing too, particularly for bigger purchases.

Popular online payment methods in the UK include:

- Debit and credit cards: A popular online payment method, particularly Visa and Mastercard.

- Digital wallets: Services like Apple Pay and Google Pay allow customers to pay with a fingerprint or face scan.

- PayPal: Offers fast checkout and strong buyer protection, popular with UK shoppers.

- Buy Now, Pay Later (BNPL): Services like Klarna and Clearpay let customers split payments over time.

- Payment links: Can be sent by email, SMS or messaging platforms, often used to pay invoices and for bookings made online.

Things to consider before choosing a payment service provider

Before signing up with a payment provider, take a step back and assess your needs:

- Customer preferences: Are your customers more likely to use Apple Pay, PayPal, or card payments? Local and demographic factors matter.

- Average order value: Higher-value items might benefit from BNPL options. Low-value items require more cost-efficient transaction fees.

- Sales volume: Microbusinesses may have different needs from scaling businesses. Choose a provider that offers fair rates at your current size but can scale with you.

- Markets served: If you plan to sell internationally, look for multi-currency support and local payment methods for different regions.

Once you have identified what you need from a payment provider, it’s important to understand their offering. Some larger payment providers are not well equipped to meet the diverse needs of small businesses and prefer to focus on serving enterprise-level clients. With that in mind, they may not offer competitive pricing, and the support they provide is also likely to be somewhat limited.

- Fees: Understand the full fee structure – setup fees, per-transaction costs, monthly charges, and chargeback fees.

- Supported payment methods: Make sure the provider offers the methods your customers want.

- Integration options: Look for seamless integration with your website or e-commerce platform.

- Customer support: Check whether support is available 24/7 and whether you will be speaking to humans, or chatbots.

- Payouts: Some providers settle funds within a day or two; others take longer. This can impact your cash flow.

When you’ve narrowed it down to a shortlist of providers, ask for a demo or trial, and don’t be afraid to ask questions. A good provider will be transparent and willing to help.

Fees charged by payment service providers

When you’ve narrowed it down to a shortlist of providers, ask for a demo or trial, and don’t be afraid to ask questions. A good provider will be transparent and willing to help.

Payment providers typically charge fees in several ways:

- Transaction fees: Usually a percentage of the transaction plus a fixed fee.

- Cross-border fees: If you sell internationally, additional fees may apply.

- Currency conversion fees: Charged when a transaction needs to be converted into GBP.

- Monthly fees: Some platforms charge a flat monthly rate for access.

- Chargeback fees: Charged if a customer disputes a transaction.

Make sure you understand how fees will be deducted and how they scale with your sales. Again, a good payment provider will be upfront and transparent about how their fees are calculated.

There may also be hidden costs to watch for.

- Payout timelines: Some providers hold funds longer than others, which can affect your cash flow.

- Payment method surcharges: Certain methods (like BNPL or American Express) may carry higher fees.

Checking your payment provider is a good fit

The provider you choose will affect everything from how quickly you get paid to how easy it is for your customers to check out. While it’s tempting to dive in and get set up quickly, it’s worth taking a bit of time to test the basics, read the small print, and make sure the solution can scale with you. A few simple checks early on can save you time, money, and hassle later.

- Start small: Don’t overcomplicate. Get the basics right, then scale.

- Read the fine print: Understand your contract, especially around fees.

- Ask for a demo: Most providers offer walkthroughs for small businesses.

- Test everything: Go through the checkout yourself to identify any issues.

- Refunds: Make sure you can issue them quickly and easily.

Switching payment providers

If your current provider isn’t cutting it, switching is possible, and often easier than you think.

- Check your contract for notice periods or early exit fees.

- Plan a clear migration timeline.

- Ensure your new provider supports data and transaction migration.

- Communicate changes to customers if needed.

A good provider will support you throughout the transition. Contact a member of the team