How to drive more conversions with open banking solutions

For today’s merchants, operating a smooth checkout and payment process is vital for reducing cart abandonment, increasing conversions and retaining customers. Open banking solutions are helping e-commerce businesses streamline the process, leading to increased sales and conversions.

Since the second Payment Services Directive (PSD2) mandated that financial institutions must allow third-party providers access to their customer’s account information and the ability to initiate payments on their behalf, open banking has been steadily growing. As a result, many businesses are embracing it to expand their offerings and provide innovative, user-friendly and instant payment options.

In this article, we’ll unpack the reasons for incorporating open banking into your payment process and how it can boost your online sales.

Open banking: What is it and how can you use it to boost your sales?

Open banking is the practice of sharing information between different financial institutions through secure and standardised application programming interfaces (APIs), giving customers more access to and control of their financial data.

Unlike card payments, which often incur high fees and chargeback risks, open banking’s secure APIs directly connect the customer's account to the merchant's account, reducing the risk of fraud, chargebacks and the associated card payment costs.

Exploring the benefits: Increasing your conversions with open banking

From providing better customer experiences to eliminating fraud risk, open banking solutions enable businesses to significantly increase conversions. Here are 6 key benefits to explore.

1. Better customer experience (СX)

Open banking makes customer payments more seamless and convenient, primarily because the payment card is not directly involved in the transaction. It also boosts customer trust by allowing individuals to interact with familiar interfaces like their bank's mobile app or website. This provides a sense of security and continuity, as customers can leverage an existing relationship with their bank to access new financial products and services from third-party providers.

2. Easier, faster checkout

Through biometric authentication, open banking eliminates the need for customers to enter their payment information or create new accounts manually, increasing convenience and speed during checkout. It also enables real-time payment confirmation, so buyers can receive immediate feedback on their purchase status, enhancing the checkout experience.

3. Flexible payment options

This innovative and safe sharing of payment data with third-party providers allows banks and merchants alike to offer customers flexible payment options through multiple digital channels, such as social media and e-commerce sites, enabling frictionless payment processing.

At Ecommpay, not only do we offer a wide variety of payment methods, from various credit cards and digital wallets to Buy Now, Pay Later finance options, but we also enable extensive open banking transactions. This helps you meet your customers’ purchasing preferences.

4. Eliminate fraud risk

Open banking solutions provide a transparent way to manage financial transactions, giving customers increased control over their financial data and which third-party providers they wish to share it with. Only authorised parties are given access to the data, reducing the risk of fraudulent activity. APIs are designed with strong security measures and standards, such as multi-factor authentication and encryption, to protect sensitive financial information.

5. Reduced chargebacks

Providing a secure and direct bank-to-bank payment process eliminates the need for intermediaries, such as card networks. Verifying a customer's identity and funds before initiating a payment reduces the likelihood of unauthorised transactions, helping to prevent disputes that may lead to chargebacks.

A more secure and reliable payment process will improve your overall buyer experience and help to increase conversions.

6. Increased innovation

FinTech innovations let businesses offer customers new and progressive financial products and services. By partnering with third-party providers, you can leverage the latest technologies, such as machine learning and artificial intelligence, to develop more personalised and relevant solutions to meet your buyers’ needs.

This also drives down your costs, as it facilitates faster, cheaper and more secure payment transactions while enabling more competitive pricing and better access to financial services.

Are you ready to embrace open banking solutions?

As you can see, open banking is having a profound impact on the e-commerce industry's digital transformation. With changing buyer demands and increasing innovation within the industry, there has never been a better time to adopt this technology.

Ecommpay’s open banking solutions offer a better way for customers to pay

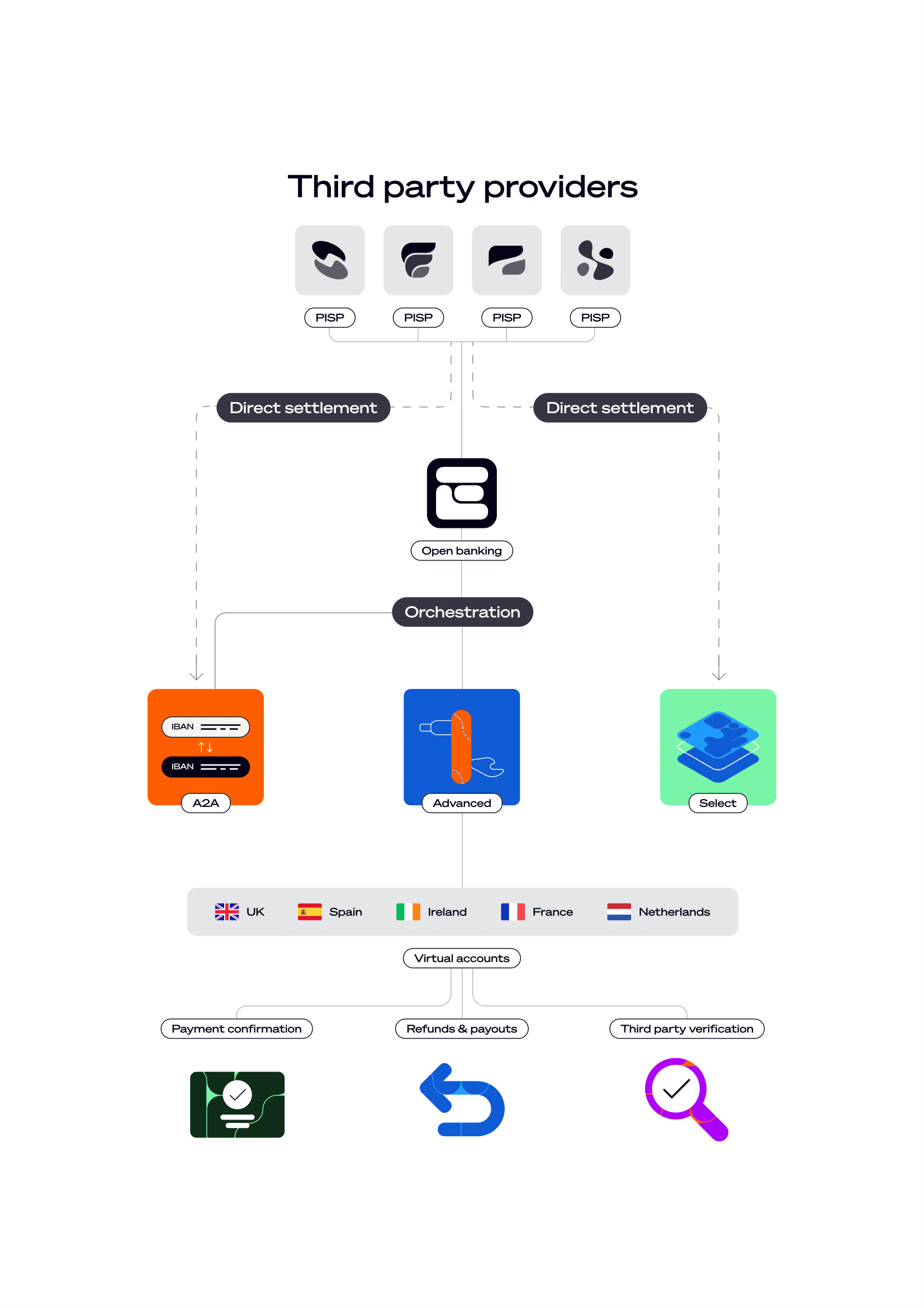

At Ecommpay, we offer three open banking solutions, “Open Banking Account-2-Account”, ”Open Banking Select” and “Open Banking Advanced”, each with different features depending on your specific needs.

Open Banking Account-2-Account

Open Banking Select

Open Banking Advanced

Ecommpay’s open banking capabilities at a glance:

- An additional revenue stream - enabling businesses to offer new financial products and services that generate revenue through transaction fees

- No chargebacks - once the user has signed in with their credentials and confirmed the payment, our platform prevents the risk of chargebacks

- Direct and instant payments - providing instant and secure transactions, increasing efficiency and customer satisfaction

- Improved conversion rates - enhance the buyer’s experience through the trustworthiness of their banking environment, leading to increased return rates

- Managed traffic for pay-by-bank pay-ins and payouts - overseeing and optimising the flow of transactions between businesses and customers, ensuring a seamless payment experience for all parties

- Complete payment ecosystem - a payment gateway that combines direct acquiring capabilities, 100+ Alternative Payment Methods, mass payouts and technological innovation within a single unified integration