Empower your checkout with Visa Instalments: A smarter way to pay - coming soon

As the cost of living continues to reshape consumer behaviour, flexibility at checkout is no longer a luxury – it’s an expectation. Today’s shoppers are increasingly looking for ways to manage their finances while still enjoying the products and experiences they value. That’s where Visa Instalments comes in.

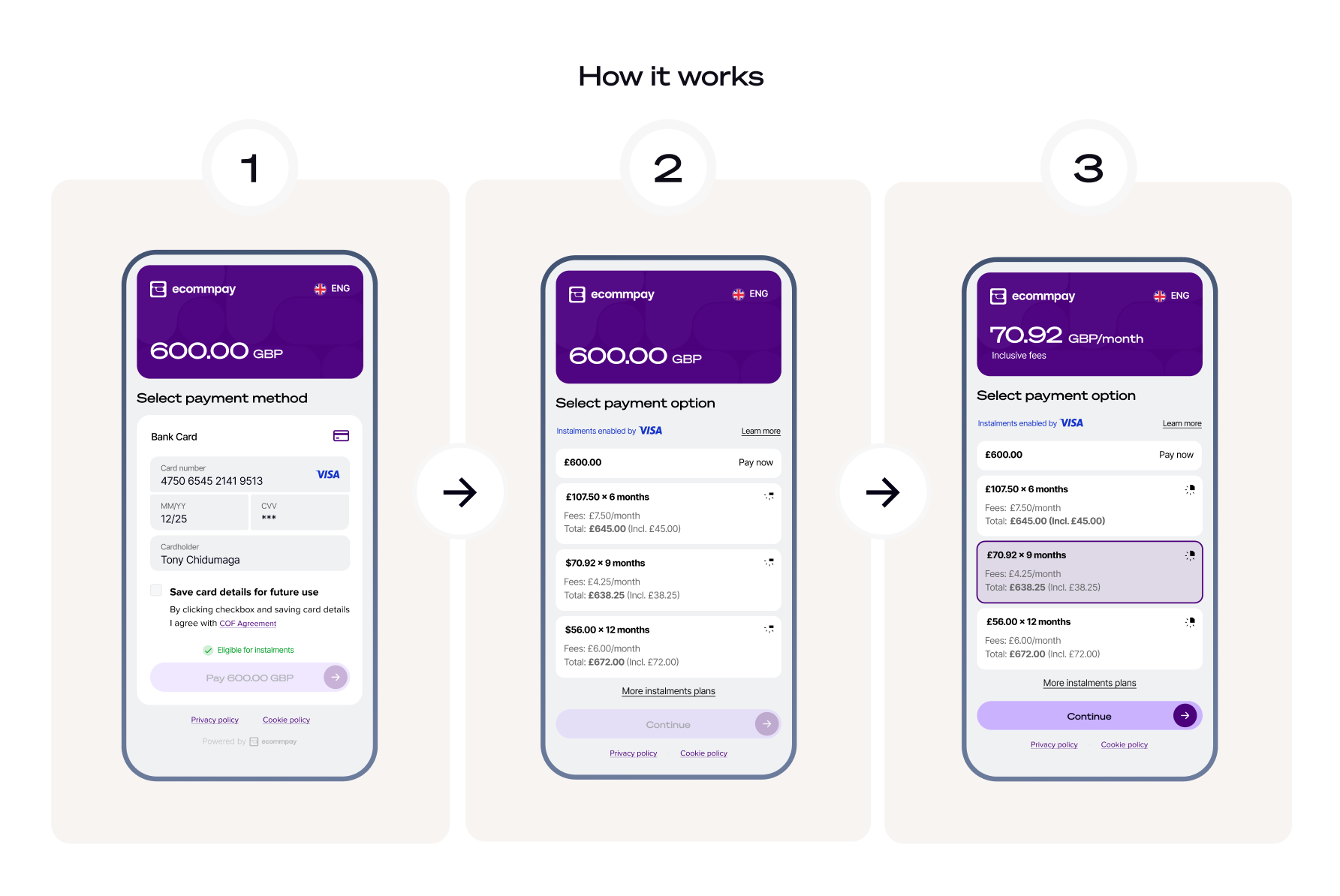

This seamless, secure solution allows your customers to split their purchases into manageable instalments, all using their existing credit cards – no applications, no delays. For retailers, this translates into increased conversions, higher basket sizes, and stronger customer loyalty.

Tap into a fast-growing payment trend

Buy Now, Pay Later (BNPL) is becoming a core part of the digital payment landscape. It already accounts for 5% of all online transactions, and is projected to grow as consumers continue to prioritise financial flexibility.

With Visa Instalments, your business can leverage this growing demand – without the friction. Unlike many BNPL options that require new accounts, credit checks, or third-party apps, Visa Instalments works natively with credit cards from participating banks. Customers simply select instalments at checkout and spread the cost over time.

It’s an easy way to increase customer spending power while ensuring that your checkout process stays smooth and secure.

Conversion-boosting simplicity

A frictionless checkout experience is critical to keeping customers engaged. According to industry data, even small delays or extra steps can result in abandoned baskets. Visa Instalments removes those barriers by allowing eligible customers to opt into instalment payments within their existing credit card flow – no extra logins, no new forms, and no unfamiliar platforms.

For merchants, this means:

- Higher checkout conversion rates

- Reduced cart abandonment

- Local payment methods

By enabling a payment method that customers already know and trust, Visa Instalments makes it easier for shoppers to say “yes” to bigger purchases.

Why your business needs Visa Instalments now

As economic pressure mounts, customers are adjusting their spending habits – but that doesn’t mean they’ve stopped buying. In fact, recent research highlights an important opportunity:

- 44% of consumers said they had less money to spend during the festive period in 2024.

- Despite tighter budgets, overall card spending grew by 1.6% across essential and non-essential categories.

- Consumer confidence rose by 8.1% in Q4 2024, reaching one of the highest levels seen in the past five years.

This paints a clear picture: consumers are still spending – but with care. They are more discerning, prioritising brands that offer value and convenience. Offering instalments through Visa helps your business align with this new financial mindset, giving customers more control while encouraging larger and more frequent purchases.

The business benefits of Visa Instalments

Visa Instalments delivers tangible commercial value for merchants of all sizes and sectors. Whether you sell electronics, fashion, furniture, travel or services, instalments can:

- 1. Boost average order values

- When customers have the option to split payments, they're more likely to purchase higher-value items or add extra products to their basket – driving incremental revenue per transaction.

- 2. Increase checkout conversion

- The fewer steps at checkout, the better. Visa Instalments integrates directly into the existing card payment process, allowing more customers to complete their purchase without hesitation or delay.

- 3. Attract and retain more customers

- In today’s competitive market, flexibility can be a key differentiator. Offering instalment payments not only attracts new shoppers, but also fosters long-term loyalty by showing that you understand their needs.

Why your customers will love it

Visa Instalments is designed with the modern shopper in mind – digitally savvy, budget-conscious, and time-poor. It delivers a buying experience that feels intuitive, supportive, and trustworthy.

- 1. Seamless and instant

- There’s no need for customers to fill out forms or download an app. If their card is eligible, they simply choose to pay in instalments during checkout.

- 2. More affordable purchases

- Instalments are either interest-free or come with low, transparent costs – giving customers more flexibility to manage their budget without resorting to high-interest debt or credit.

- 3. Confidence in every transaction

- Backed by Visa and trusted banking partners, Visa Instalments gives shoppers the peace of mind that comes with familiar names and proven security.

Global-ready, regulation-friendly

Visa Instalments isn’t just scalable – it’s smart. Designed with international merchants in mind, it supports:

- Multiple payment methods.

- Multi-currency transactions.

- Custom payment workflows.

- Global availability with local compliance.

Whether you're navigating regulatory requirements or managing complex financial operations, Visa ensures funds are safeguarded and fully compliant, no matter where your customers are.

Ready to add Visa Instalments to your checkout?

Visa Instalments is more than a payment method – it’s a powerful tool to elevate your customer experience, increase sales, and stay competitive in a shifting economic climate. It meets your customers where they are, offering the convenience, flexibility, and confidence they need to keep spending – without hesitation.

Let your checkout work harder for your business. Add Visa Instalments and turn browsing into buying – while giving your customers the freedom to shop smarter.

**Instalments are not available on all credit cards and are only offered by certain participating card-issuing banks to eligible cardholders on qualifying purchases. Instalments are a form of credit. The amount will be deducted from the cardholder’s existing credit limit on their payment card. It is important to repay all instalments in full and on time. If the cardholder does not make payments on time, the issuing bank may charge fees, cancel the instalment plan, and/or apply interest to the instalment purchase. Instalments are offered by the card-issuing bank, not by Visa. For more information, please contact your issuing bank.