How does open banking benefit businesses?

How does open banking benefit businesses

You’ve probably heard the term 'open banking’. But what does it mean exactly? And what are its implications and benefits for e-commerce, the customer experience and your business?

What is open banking?

Open banking is a term agreed for a new standard of account-to-account (A2A) payments. In open banking, other financial institutions (banks) and regulated third-party payment providers (TPPs) are permitted access to consumer bank account information and transactional data. This access can also be used for payment initiation, enabling payments to be ‘pushed’ securely from one account to another.

Open banking differs from traditional account-to-account payments because of the speed, the breadth of parties able to participate in data exchange and the digital extraction of data. Banks and financial institutions provide application programming interfaces (APIs) to facilitate this sharing with regulated TPPs. APIs enable seamless communication and data transfer, while ensuring secure integration between the customer’s, TPP’s, and bank’s systems.

In practice, open banking provides:

-

A more joined-up view of money for businesses, including being able to move money between multiple financial service providers with less friction, and improved cash flow due to the increased speed of fund transfer

-

More personalised product design, better rates and risk management for banks and other financial services organisations

-

A way for regulators to foster open competition, drive market efficiencies and protect users

-

An improved way for e-commerce merchants to accept bank payments and increase payment option choice

What are open banking payments?

Put simply, open banking, as a payment method, allows your customers to pay directly from their bank account to yours (account to account).

Open banking technology gives businesses access to multiple banks – up to 80% in Europe and the UK – via one connection to Ecommpay. So, let’s say you’re a UK-based e-commerce business that wants to expand into the Netherlands, where the most popular banks are ABN AMRO, Rabobank and ING. This differs from Germany, where the largest banks are Deutsche Bank, DZ Bank Group and Commerzbank.

Using open banking payment providers allows payments to be accepted from all these banks and more. Your customers can pay you via their preferred local bank account, with it remaining the same bank account-funded payment they know and trust. It’s convenient for them, but also helps you expand cross-border more easily. And when funds are usually on your account in less than 15 seconds, what’s not to like?

Open banking enables instant settlement, no fraud, no chargebacks, and instant refunds, yet many merchants are not yet adopting it, due to a lack of consumer demand.

According to our research, merchants have expressed high levels of interest in open banking as an Alternative Payment Method (APM), with a third of respondents stating that they see it as a payment type with the most opportunity for business growth. However, many businesses (and consumers) need clarification about what open banking is, and what the benefits are.

Open banking regulation

Open banking is one of the safest Alternative Payment Methods, and yet, with consumers’ limited understanding of what it means, many assume it is unregulated, and therefore, unsafe.

Open banking was made possible through a combination of technological innovation and regulatory frameworks, most notably the second iteration of the Payment Services Directive (PSD2) in the European Union.

Implemented in January 2018, PSD2 is the cornerstone regulation that enabled open banking in Europe. It aims to strengthen the rights of consumers in the digital payments landscape, as well as encourage new entrants and innovative payments services by opening up the market. It also enhances the security of electronic payments to protect against fraud and other risks.

PSD2 requires banks to provide third-party providers (TPPs) with access to customer account information and payment initiation services, given customer consent. Achieved via Access to Account (X2SA) services, this is a fundamental change that breaks the monopoly banks had over customer data.

In addition, PSD2 mandates enhanced security measures to verify the identity of users accessing financial data or initiating payments. Strong Customer Authentication (SCA) ensures that open banking transactions are secure. Furthermore, PSD2 establishes a framework for the regulation and oversight of TPPs, ensuring they meet security and operational standards. In turn, this builds trust and confidence in open banking services.

The regulatory landscape is set to change again in 2026, when PSD3 is set to be implemented. This signals a new chapter in open banking, setting out six aims for the future, including greater combatting and mitigation of payment fraud; enhancing the rights of consumers; providing equal access to payment systems for banking and non-banking bodies; spreading open banking further; improving cash availability at ATMs; and greater enforcement of the latest laws. This has the potential to greatly improve the performance of open banking APIs and boost the adoption of open banking services.

Nevertheless, the success of PSD3 will hinge on the industry's ability to achieve the ambitious objectives outlined in the directive and the effectiveness of the regulatory updates in tackling the current challenges faced by the sector.

The final version of PSD3 is anticipated to be published by late 2024 or early 2025. Following this, EU member states will have an 18-month transition period to transpose the directive into national law and prepare for compliance with the new regulations.

While PSD2 is an EU-wide open banking regulation, there are plenty of other global standards in place. These include the UK’s own open banking Standard, which opens secure connections between apps and banks to enable innovation across financial services and e-commerce. Similarly, countries like Mexico, Brazil and Australia utilise FinTech Law, open banking Brasil and Consumer Data Right Rules respectively. Elsewhere, India has the United Payments Interface (UPI), while Hong Kong has implemented the Open API Framework for its banking sector.

Is open banking safe?

Open banking is designed to be safe, with multiple layers of security, stringent regulatory requirements, and robust consumer protection measures.

Several built-in features of open banking make it a secure and trusted payment method. For instance, it uses secure APIs that only authorised parties can access, to facilitate data exchange between banks and third-party providers. Data is also encrypted during transmission to prevent unauthorised access and ensure that, even if intercepted, it cannot be read or tampered with.

Bank account-funded payments are so-called ‘push payments’. E-commerce merchants provide their account details for customers to ‘push’ payments to them, enabling them to take payments instantly and securely without card data. At the same time, customers aren’t required to type out their card details each time they make an online purchase; there is therefore no need to consent to this information being stored on file (unlike pull-based card payments).

Customers also log into their online/mobile banking and authorise payments using bank-grade security - part of the Strong Customer Authentication (SCA) discussed earlier. This requires at least two of the following three elements for authentication:

- Something they know e.g. a PIN or password

- Something they have e.g. a hardware token or smart device

- Something they are e.g. biometric data, such as a fingerprint or voice recognition

These elements of the SCA ensure increased security when customers are banking or shopping online.

How do open banking payments work?

Open banking securely connects customers to their online banking during checkout, allowing them to pay directly from their bank account.

The simple step-by-step process is as follows:

- You add ‘Pay by Bank’ to your payment methods at checkout

- Your customer chooses their bank, logging in and authenticating their identity as they usually do for their banking services (e.g. username and password, Touch ID, Face ID etc.)

- Your customer reviews the pre-filled information (amount, recipient, etc) and authorises the payment (which may require an additional step, such as entering a password sent to their mobile phone)

- The funds are debited from the customer’s account and are credited to yours, with you both receiving confirmation of the transaction

When it comes to payouts, it’s even easier:

- You add ‘Payouts’ to your payment methods

- You enter the payment details of the customer or supplier and the required amount, and authenticate the payee details

- The authorised payout is then sent instantly

Payouts utilise the same secure and efficient infrastructure as open banking payments, ensuring fast and reliable transactions.

Who uses open banking?

Open banking is used by a wide range of stakeholders within the financial services ecosystem, including consumers, businesses, FinTech companies, traditional banks, and third-party providers (TPPs). It has numerous applications that streamline payments, improve financial management and foster innovation.

Some examples of its application include:

Businesses

E-commerce platforms: Online retailers integrate open banking payment options to allow customers to pay directly from their bank accounts, reducing reliance on card networks and lowering transaction fees.

Subscription services: Companies like Netflix use open banking to set up direct debit mandates easily, ensuring seamless and secure recurring payments.FinTech companies

Lending platforms: Lenders use open banking data to assess borrower creditworthiness more accurately and quickly, leading to faster and more tailored loan product approvals.

Investment apps: ‘Robo-advisors’ use open banking to provide holistic financial advice by accessing comprehensive financial data from multiple accounts.Traditional banks

Account aggregation services: Some banks offer account aggregation services that allow customers to view and manage accounts from different banks within a single app.

Enhanced customer insights: Banks also use open banking data to gain deeper insights into customer behaviour, enabling them to offer personalised financial products and services.Third-party providers (TPPs)

Payment processors: Companies like Ecommpay use open banking to facilitate direct bank transfers for businesses, providing an alternative to card payments.

Accounting software: Platforms like QuickBooks and Xero integrate open banking to automate bank reconciliation, providing real-time financial updates and reducing manual data entry.Consumers

Personal finance management: Consumers use personal finance management and budgeting apps that aggregate account information from various banks to provide insights into spending, budgeting and saving.

Payment initiation services: Services like the Pay by Bank app allow consumers to make online payments directly from their bank accounts without requiring card details.

How open banking benefits businesses?

Open banking offers numerous benefits to merchants and online businesses, fundamentally transforming how they handle payments, manage financial data, and interact with customers. It helps them lower payment costs, strengthens payment authorisation, and removes the possibility of chargebacks. They also receive instant payment straight into their bank account.

Value – invariably cheaper than card payments, bank account-funded transfers have no concept of a chargeback, which also saves on the cost and back-office admin of disputed payments.

Choice – giving your customers more choice in how they pay helps boost conversion, especially as almost three-quarters (71%) of consumers say they would be ‘very’ or ‘somewhat’ likely to abandon their checkout and shop elsewhere if their preferred payment method wasn’t available.

Convenience – with some payment service providers, such as Ecommpay, you can access multiple bank accounts in multiple countries, making it easier to grow cross-border via a single integration.

Speed – faster than cards with funds on account in 15 seconds, there’s no waiting around or chasing up late payments which may never arrive.

Verification - instantly verify customers’ bank account details through secure APIs, removing error, reducing the risk of fraud and streamlining the onboarding process.

Refunds - quickly process refunds and send them directly to bank accounts, without the need for intermediary services, to improve levels of customer satisfaction and loyalty.

Reverse payments - if an error occurs in a payout, a platform using open banking can reverse the payment swiftly, correcting the mistake with minimal delay, while providing traceable records of the transaction.

How does open banking benefit my customers?

Letting customers pay directly from their bank account in a matter of seconds complements existing payment methods - improving choice, customer service and conversion.

Choice – bank account-funded payments are the preferred option for many Europeans. Why make them do anything differently when shopping on your site?

Convenience – in a world of Netflix, Uber, Spotify and Deliveroo, customers expect convenience and instant service. Now, payments are no different, thanks to direct-from-bank-account transfers that customers know and trust.

Speed – by eliminating the need to type in card details, such as expiry dates etc, online checkout is faster and more frictionless than ever. The potential for errors, data theft and chargeback fraud is also greatly reduced.

How else can open banking be used?

Because open banking is essentially the foundation upon which other services can be built and run, the possibilities for new products and applications are endless.

For example, open banking can be used for financial management, providing individuals and businesses with tools and insights to help them look after their finances more effectively. Having the means to view their finances in one place enables them to keep a keen eye on everyday expenditures, savings and loans. It can also aid with planning for the future, either in terms of borrowing or saving up a ‘rainy day fund’ for emergencies.

Any knowledge of past, present and potential customers can also benefit providers, with open banking allowing them to offer new products, better services and improved rates. This could range from the initial verification of accounts, identity and income at sign-up, to improved forecasting, accounting and access to capital.

Furthermore, open banking can optimise cross-border payments, making them faster, more cost-effective and efficient. It enables real-time or near-instantaneous transfers, drastically reducing the time required for funds to move across borders compared to traditional banking methods.

In addition, by bypassing traditional intermediaries like correspondent banks, open banking significantly lowers transaction fees associated with cross-border payments. Its enhanced security reduces the risk of fraud and protects sensitive financial data during international transfers. Plus, real-time access to exchange rate data ensures that transactions occur at the most favourable rates available while remaining fully compliant, transparent and traceable.

Open banking statistics

Open banking has been growing in several countries, but the UK is a standout success in terms of adoption.

According to the Competition and Markets Authority, as of 2022, open banking had more than 6 million active users in the UK. This was significantly higher than penetration rates in Europe, where PwC estimated that just 2% of digital consumers in France, Spain, Italy and Germany used open banking in 2022. At the time, the UK was 9.2%.

Open Banking Ltd (OBL) published an impact report in March 2024. The data revealed that by January 2024, the proportion of digitally active consumers using open banking grew to 13% (1 in 7). This was a notable increase from June 2023, when it was 1 in 9. And it’s not just consumers using open banking more and more. Small business penetration has climbed to 18% (1 in 5).

There was also growth in open banking payments, with the number recorded by OBL reaching 14.5m in January 2024. This represented a 69% year-on-year growth. 8% of these payments were variable recurring payments, and 92% were single immediate payments.

As of July 2024, OBL reported that there are now 10 million consumers and businesses using open banking technology. OBL also reported growth in Payment Initiation Service (PIS) users over the past 12 months (61% year on year), and growth of Account Information Service (AIS) users in recent months (currently 27% year-on-year).

The number of open banking API calls made worldwide is expected to grow from 102 billion in 2023 to 580 billion by 2027. Countries such as Brazil have also embraced open banking initiatives, and have seen rapid adoption. In June 2023, Brazil’s 4.8 billion successful API calls were more than quadruple the UK’s 1.1 billion.

While these figures are impressive, there is still a long way to go before open banking is fully embraced by consumers and businesses alike - especially when it comes to open banking payments specifically.

What’s next for open banking?

The UK and EU were among the first to mandate some form of open banking, with many other international territories having since followed suit. Indeed, countries from Australia to America, Brazil and Canada to India and Singapore, are all exploring and investing in open banking.

Take-up has also been growing, with the latest figures revealing that open banking-enabled products are being used by over seven million UK consumers and small businesses. Around 750,000 small to medium-sized enterprises (SMEs) are also using open banking products.

According to Statista, the number of open banking users worldwide is expected to grow at an average annual rate of almost 50% between 2020 and 2024. Europe is predicted to be the largest market, forecast to reach 63.8 million users by the end of 2024.

As the interest in and use of open banking continues to grow globally, so does its scope. open banking is evolving into open finance, expanding its scope beyond traditional banking to encompass a wider range of financial products and services. This will provide consumers and businesses with a more comprehensive and integrated view of the monetary landscape, extending data to include financial products such as mortgages, savings accounts, investments, pensions, loans, insurance - and more.

Open finance signifies the next generation of digital financial services and is expected to inspire further innovations, including personalised financial advice, integrated financial management and better access to credit. By involving a wider range of institutions, such as insurers, pension providers and investment firms, open finance encourages a more interconnected ecosystem, where diverse financial ‘open’ data can be utilised to create innovative products and services.

Open banking payment solutions from Ecommpay

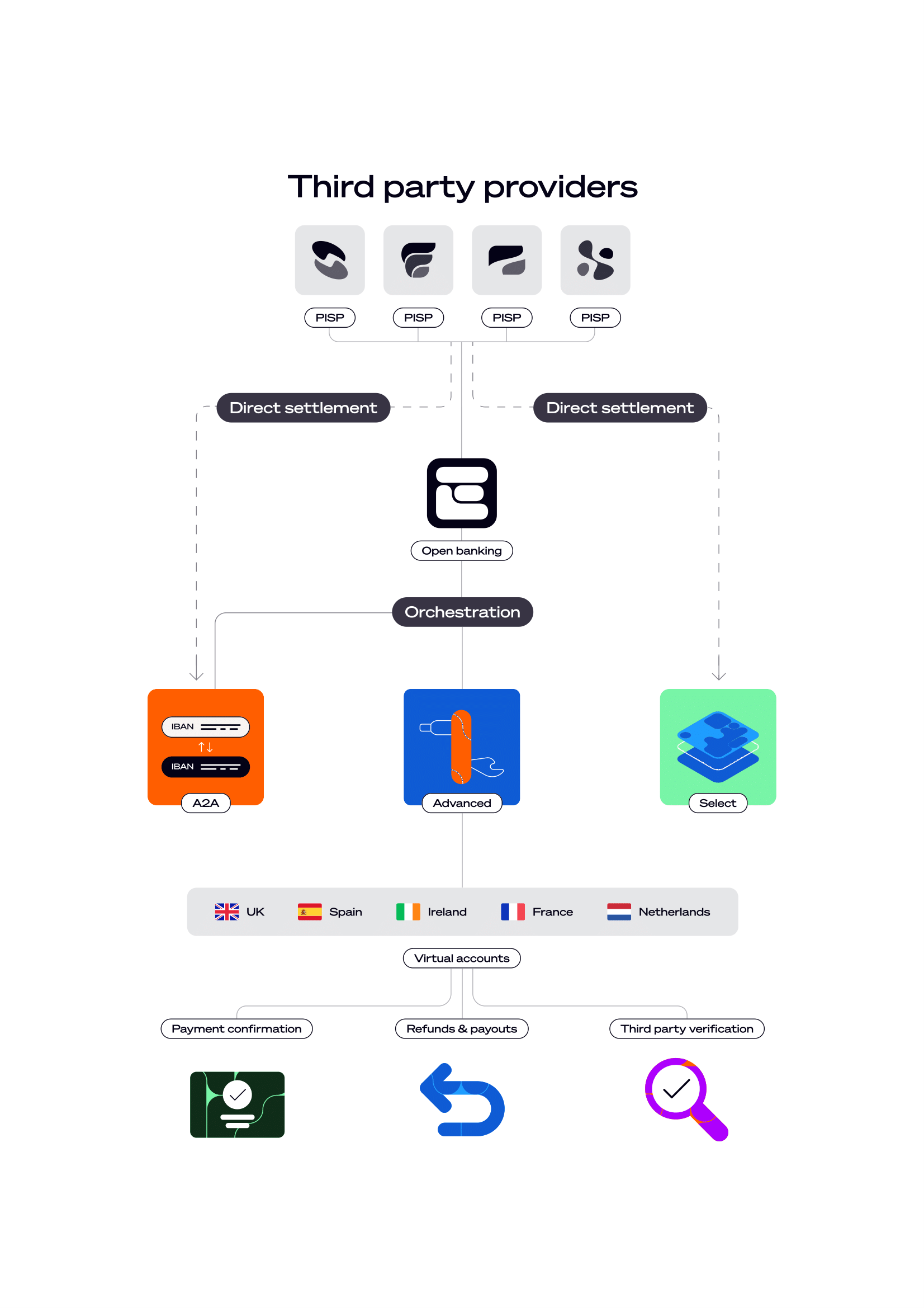

Ecommpay provides unrivalled access to the open banking ecosystem in the UK and EEA.

In addition to account-to-account (A2A) open banking, Ecommpay provides an advanced open banking solution that offers pay-ins, payouts, and refunds from a dedicated virtual account.

This helps to improve efficiency, with automatic reconciliation, funds aggregation, and immediate payment confirmations, even for cross-border transactions across Europe, and the UK.