New Ecommpay platform features: flexible payments, customisation, and simplicity for merchants

The world of e-commerce is constantly evolving, and merchants need payment solutions that offer flexibility, simplicity, and global reach. Innovation at Ecommpay is driven by a simple principle: understanding and responding to the needs of our customers. With that in mind, we’re excited to introduce new features to our platform that are designed to increase efficiency, simplify operations and fuel revenue growth.

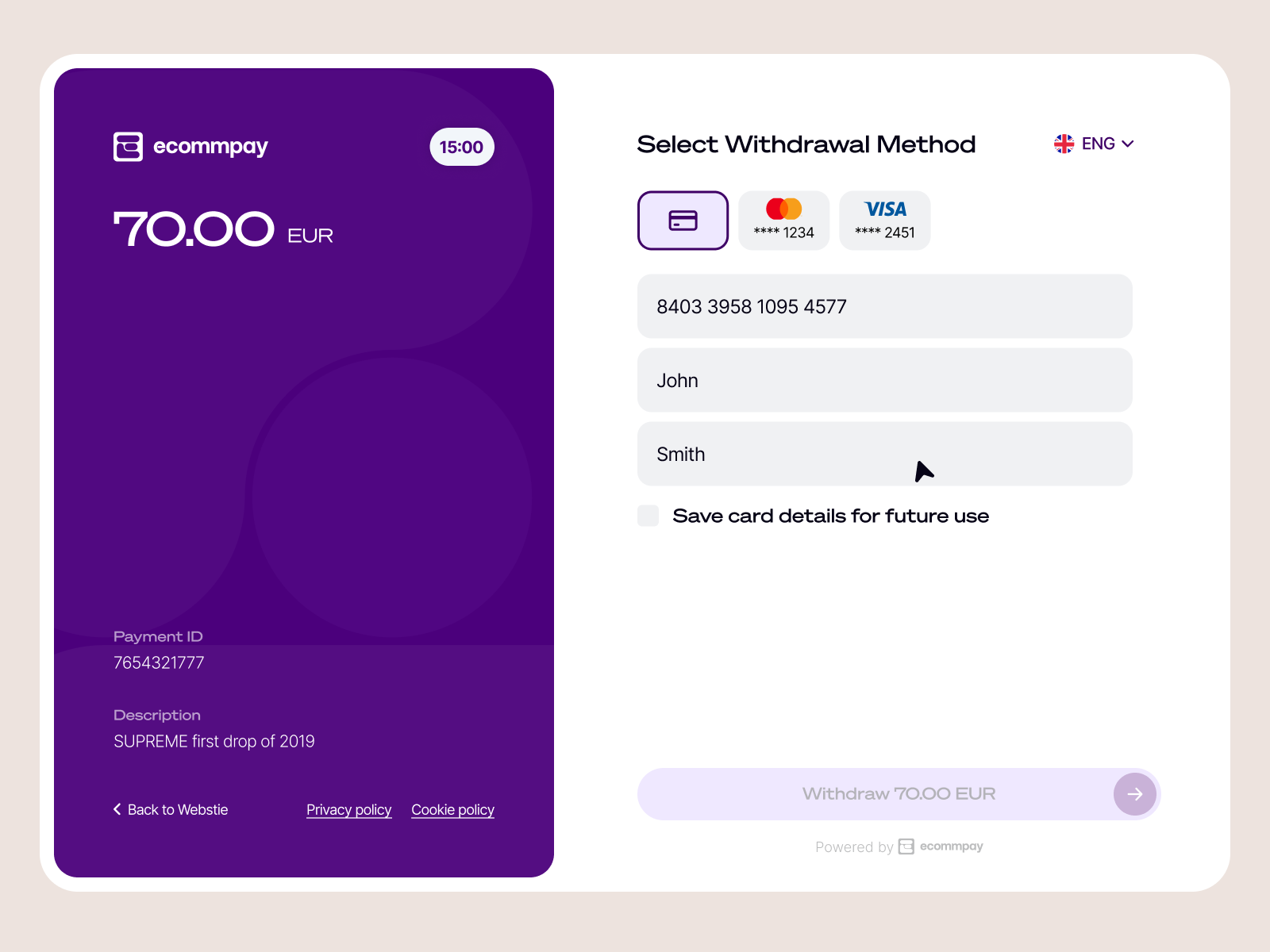

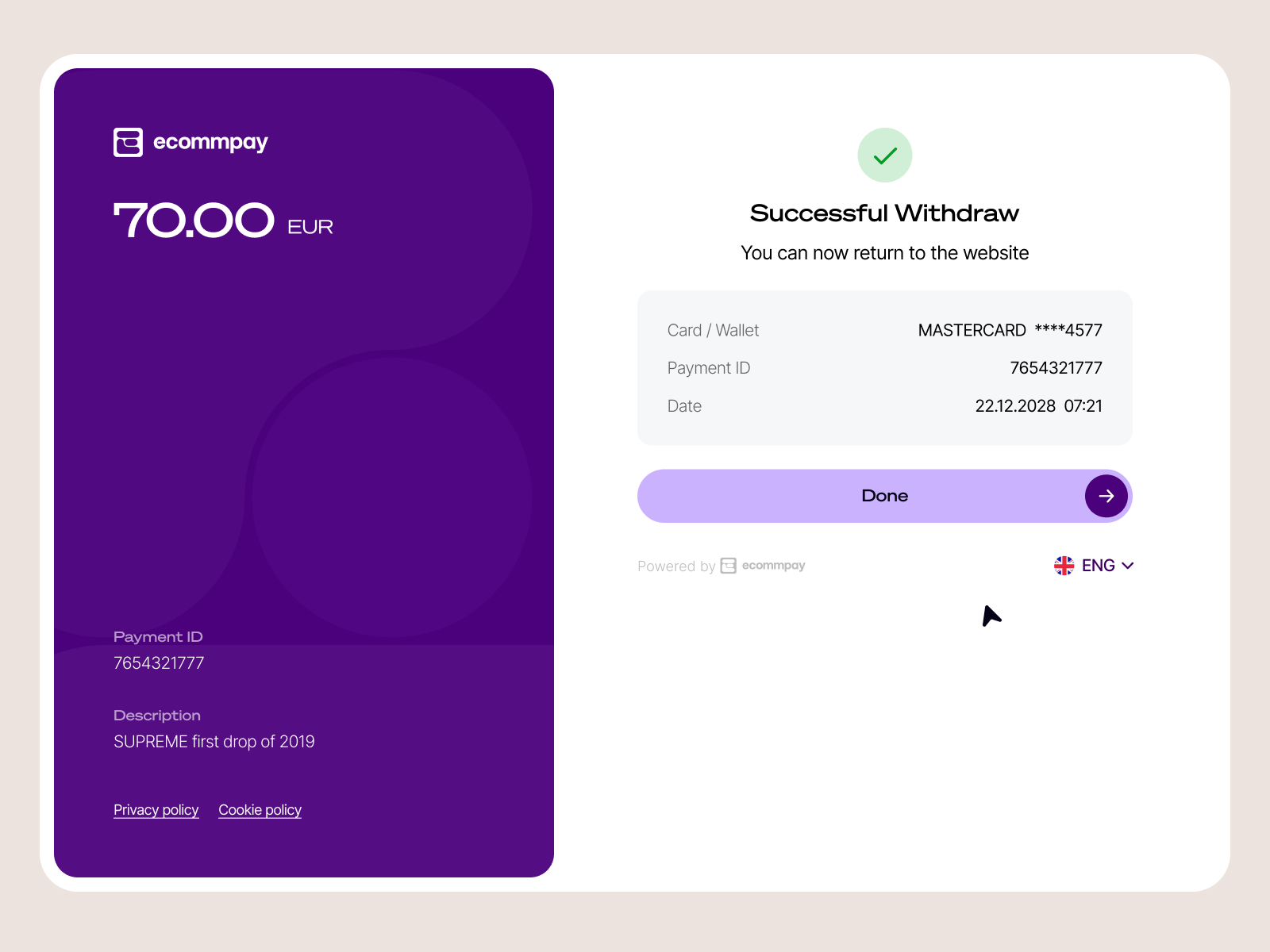

Introducing our payouts via a hosted payment page

Managing payouts shouldn’t require navigating complex API integrations. Our payouts via a hosted payment page solution is a hassle-free one-time integration so you can easily send money to customers, freelancers, contractors, and other beneficiaries.

How this solution helps our merchants

With payouts via the hosted payment page, we eliminate long development cycles, allowing us to get you up and running in no time. While our solution simplifies the process, it does not compromise security. Ecommpay is PCI DSS Level 1 compliant and fully committed to safeguarding your sensitive data, reducing the risk of data breaches and fraud.

The benefits for your customers

Your customers can complete payouts by entering their payment details directly on the customisable payment page, ensuring a smooth and intuitive customer experience.

Is it right for you?

This solution is ideal for merchants looking to scale payouts without investing time or money on a full development team or technical resources.

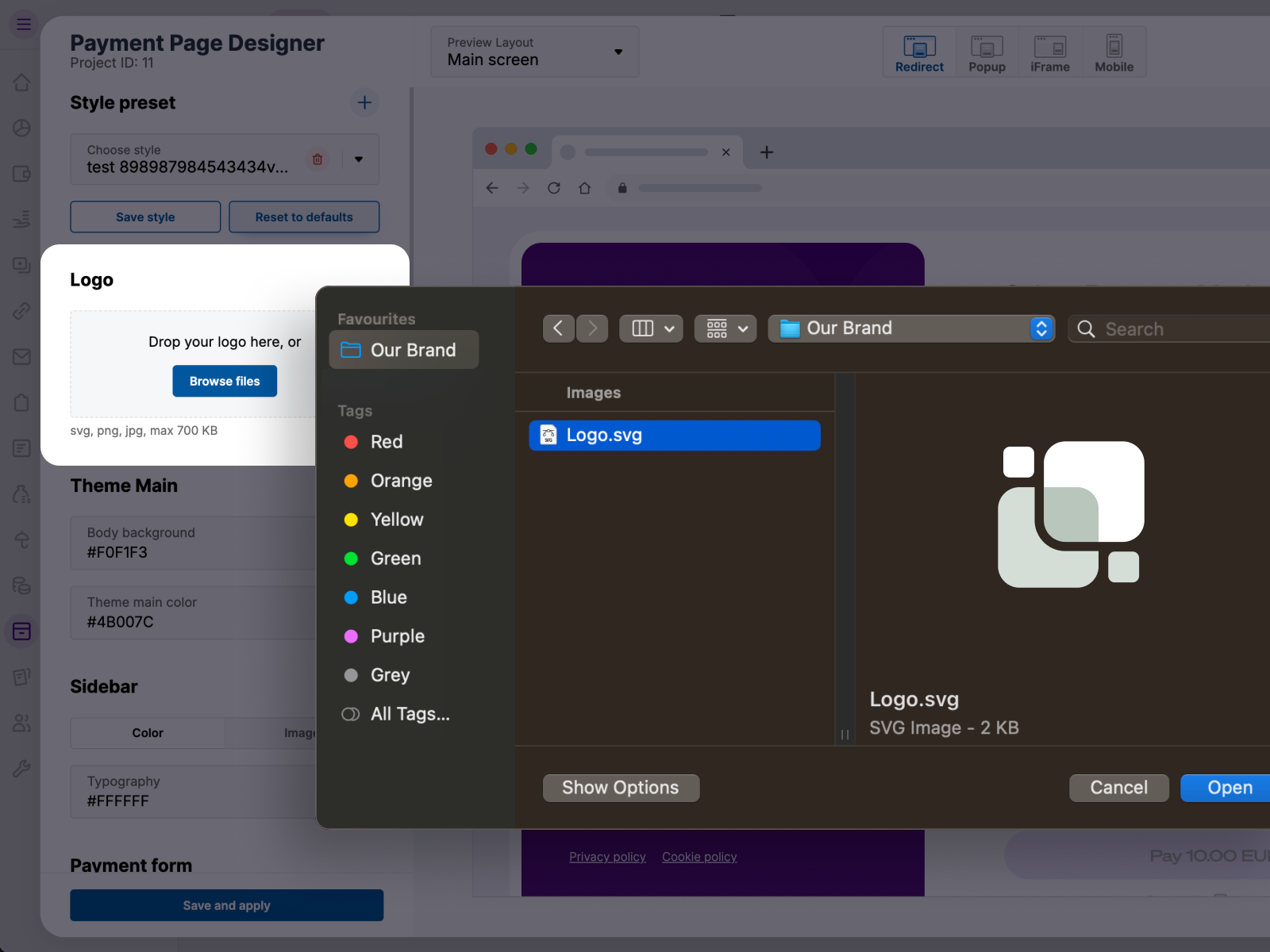

Introducing our payment page designer

Your checkout page is more than a payment gateway - it plays a crucial role in the e-commerce ecosystem and is a chance to create a seamless customer experience. That’s why we’re introducing the payment page designer tool, a feature that is intuitive, flexible and easy to use, and the perfect solution for merchants who want an online payment page design that will boost trust and payment conversion.

How this solution helps our merchants

With this tool, you can customise fonts, colours and themes, tailoring the payment page to reflect your brand’s identity with complete creative control. You can leverage CSS functionality, creating visually compelling, brand-aligned designs that enhance trust and drive conversions

The benefits for your customers

The solution’s A/B testing capabilities will also help you to refine the customer experience, testing responses to different layouts and themes, gathering valuable insights into what resonates most with your audience.

Is it right for you?

The payment page designer tool gives you full creative freedom, allowing you to deliver an immersive and on-brand experience for your customers.

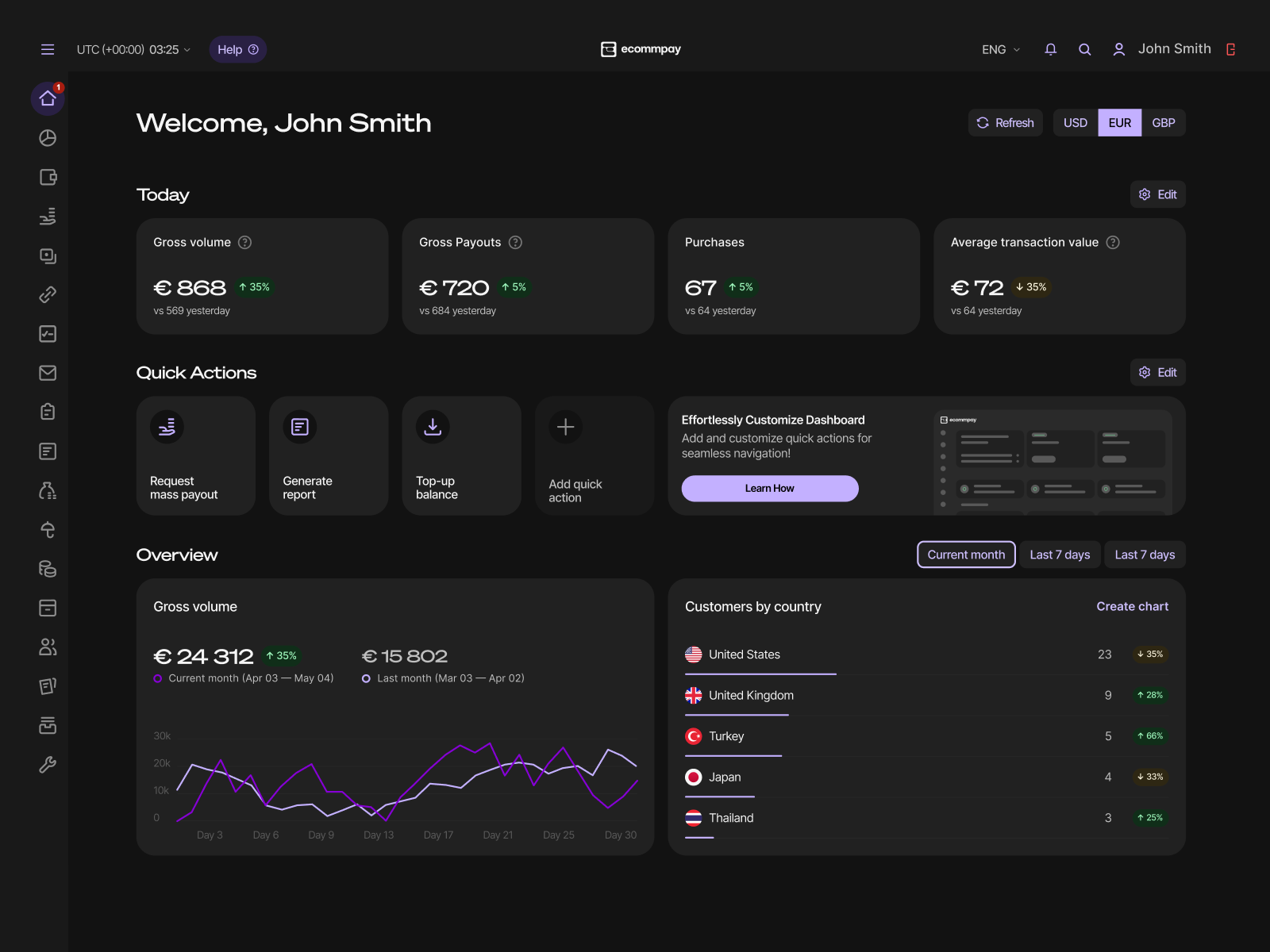

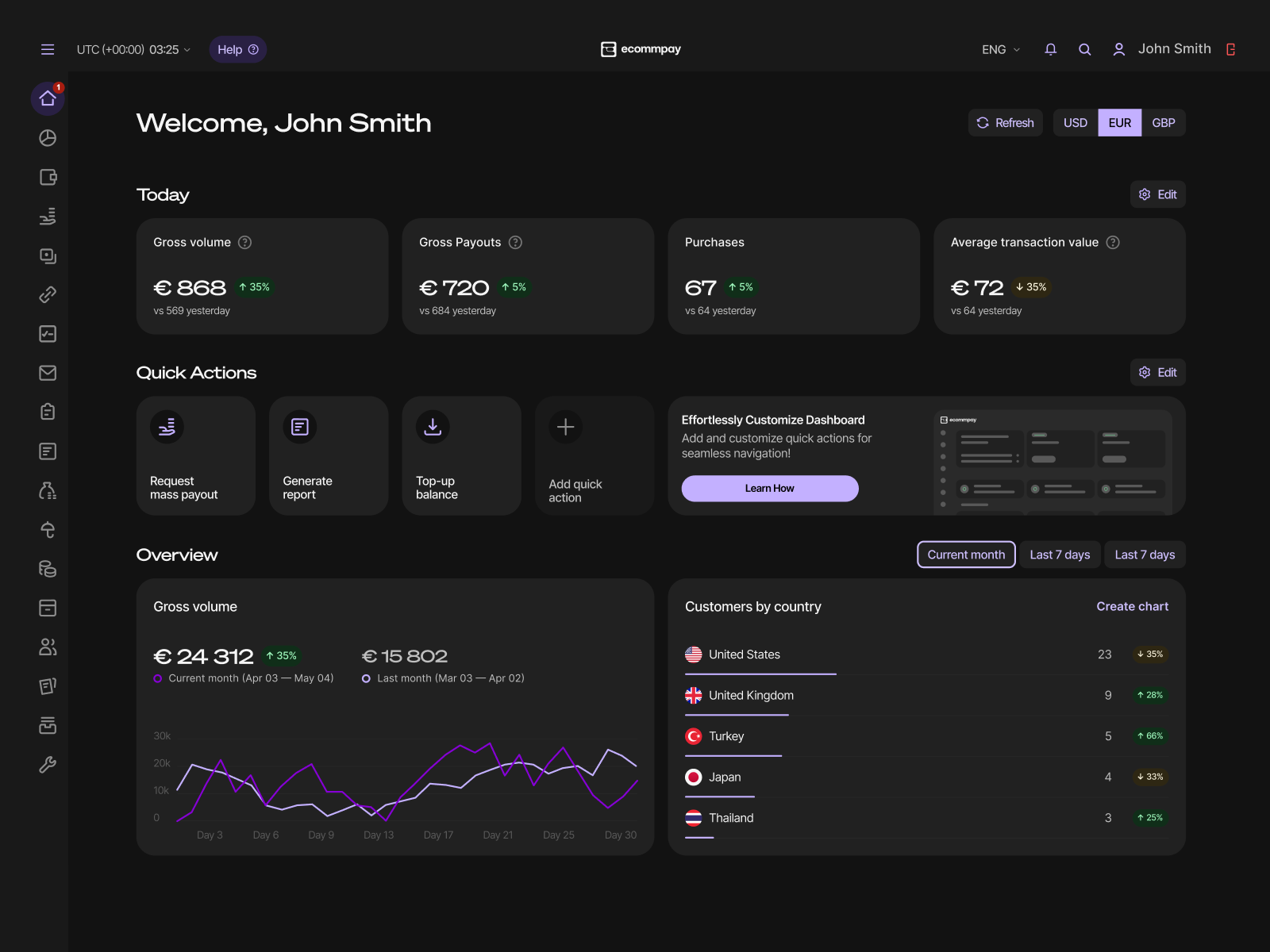

Introducing merchant dashboard dark mode and customisable colour themes

Your workplace should work for you. That’s why we’ve introduced dark mode and customisable colour themes for the merchant dashboard. This update allows you to create a more comfortable and personalised experience, improving both usability and productivity.

How this update helps our merchants

A light theme is known to cause eye strain and discomfort with prolonged use, but switching to our new dark mode will be gentler on your eyes and improve readability. You can also now choose from a variety of colour themes to match your brand or personal preference, creating a dashboard that is uniquely yours.

Is it right for you?

These enhancements provide a more comfortable, user-friendly dashboard experience, allowing you to focus on running your business.

Learn more about the functionalities of our merchant dashboard here.

Introducing new APMs: MB WAY and Swish

Research from IMRG found that businesses who do not offer localised payment methods could be missing out on key growth. With this in mind, we’re now offering Portuguese and Swedish Alternative Payment Methods, MB WAY and Swish, to our merchants, to help them drive conversions and expand their businesses.

How these solutions help our merchants

MB WAY and Swish are two of Portugal and Sweden’s most popular payment methods, trusted by millions of users. Adding these APMs to your offering is a quick way to broaden your regional reach.

The benefits of MB WAY

MB WAY maintains a 45% market share of all e-commerce transactions in Portugal, making it the ideal payment method for expanding your business. Your customers will trust the security of the e-wallet, which allows them to make payments, send or request money, and manage funds using the mobile app, without having to input card details in every transaction. This improves the customer experience which can lead to higher conversion rates.

The benefits of Swish

Swish is one of the leading Swedish payment methods, making up 6% of all total transactions. As a bank transfer solution, Swish not only unlocks a new customer market but gives businesses instant access to funds.

Are they right for you?

Both MB WAY and Swish offer an overall simplified payment experience, meaning fewer abandoned checkouts and more completed sales.

Most importantly, by adding regional payment methods to your offerings, you can connect with a key market and provide a localised checkout experience.

Conclusion

E-commerce is evolving, and we, along with our merchants, are evolving with it. Our commitment to innovation means you’ll always have the tools you need to grow, adapt, and thrive. From flexible payment solutions like Humm to design tools and regional payment methods, we’re here to help you unlock your business’s full potential.

Explore these new features today and see how they can transform the way you do business. Connect with a member of our team to find out more.