Understanding Payment Initiation Service Providers (PISPs) and their role in open banking

Open banking is gaining ground in Europe and the UK, offering fundamental changes to online businesses and the financial services market. Payment initiation service providers (PISPs) play an important role in the open banking payment process. Let’s take a closer look at the technology to see how it works, whether your business needs it and if your customers are ready for it.

First things first: what is a PISP and what is its role in the payment process?

Payment initiation service providers (PISPs), or third-party providers (TTPs), are companies authorised to carry out transactions on the customer’s behalf. Payment initiation services refer to online payments where credit or debit cards do not have to be present to initiate transactions.

All PISPs are independent, meaning they are free to choose which banks they work with. End-users can grant the PISP access to their bank account(s), regardless of the bank they use, allowing the customer to pay invoices via the PISP, rather than logging in and paying via an online bank account. So, in a nutshell, using payment initiation service providers is a great way to save time.

PISP vs AISP: what’s the difference?

Account information service providers (AISPs) access information kept at financial institutions on behalf of customers. They can connect to bank accounts to see the information and use the data for analysis, but they cannot execute transactions. For example, account information service providers can check the credit history of a customer applying for a loan, but to initiate transactions and make open banking payments possible, a payment initiation service provider is an inevitable link in the process chain.

What is open banking?

Open banking transactions are instant payments from one bank account to another, giving customers control over their own banking data. Customers can grant PISPs, such as FinTech companies, online businesses, and messaging apps access to this data, and the PISP can analyse this information, or use it to initiate transactions.

Open banking is made possible by the new regulations introduced by the Revised Payment Services Directive (PSD2). The directive was introduced by the European Commission to lower the entrance costs in FinTech markets and make online transactions safer. Under PSD2, payment initiation service providers that are granted a customer’s consent are then allowed to ask for permission to access their bank account data.

Open banking uses open APIs (Application Programming Interfaces) to access and exchange this banking data. This is an openly available set of instructions that explains how to connect to a computer system and transfer data. For example, you might have seen a third-party website that allows you to log in using your Facebook data - this login data is transferred via an API. Of course, you still need to approve the connection; the API describes how to transfer the data, but you grant access.

How can customers benefit from open banking?

The main benefit of open banking for customers is the simple consolidation of their bank accounts. For example, if you (the customer) have multiple different bank accounts, you’ll need to use each of their individual banking apps to access all of your finances. With open banking, you can use one consolidated app to view all of your bank accounts, including checking the balance of every account, making payments, and reviewing transaction history.

Integrating with payment initiation service providers allows customers to make payments with their bank account simply by using Strong Customer Authentication - using their Face ID/Touch ID to log into their bank account and confirm the payment.

Direct account-to-account (A2A) payments are especially attractive for e-commerce businesses, such as online retailers, ride-hailing apps, and e-learning platforms.

It’s not just an imaginary scenario; open banking is up and running, and gaining ground. As of March 2025, open banking adoption in the UK reached a new milestone, with 13.3 million active users. This represents 18.4% of individuals and small businesses with online access to their current accounts.

Over the past five years, open banking penetration has shown a consistent upward trend, with year-on-year growth rates ranging between 40% and 50%. If this trajectory continues, it is anticipated that by the first half of 2026, one-quarter of accounts will be active in open banking. The user base is continuously growing, with more and more people getting familiar with open banking and appreciating its features.

What are the advantages of open banking for online businesses?

- Payment safety: Open banking does use open APIs but the customer still has to allow (or decline) any attempts to connect to their banking data by undergoing their bank’s authorisation. This may include biometrics, a one-time password, an additional app, or other solutions that ensure safety while maintaining ease of use. Moreover, open banking uses 3D Secure 2.0 on all its transactions, an additional two-step authentication protocol that confirms that it really is the customer making the payment. This means that a potential attacker would have to defeat both the banking authorisation and the additional 3D Secure protocol.

- No chargebacks: The customer makes direct account-to-account payments; no payment cards are involved, eliminating the risks of chargebacks. The two-step authentication means it’s almost impossible to make accidental payments, and makes it harder to argue that a payment should be returned.

- Direct payments to bank accounts: Account-to-account payments are faster as there’s no need for intermediaries, such as payment card processors. Businesses also don’t have to wait for payouts - they arrive as soon as the bank processes them. In many cases, it can be performed almost instantly.

- Lower transaction costs: Open banking payments are cheaper than card payments. With card payments, the bank that issued the card receives most of the transaction costs, charging for the use of their infrastructure, payment verification, and processing the customer data. Under open banking, the infrastructure can be used free of charge which is especially cost-effective for businesses and customers making large transactions.

In summary, open banking allows businesses to receive money directly from the client, with faster payments and fewer intermediaries. This enables them to develop flexible payment systems for different usage cases, currencies and regions.

Sounds good. What are the drawbacks?

Even though open banking does come with robust safety protocols, any new technology brings new security risks, such as identity theft and security breaches. However, developers are aware of these issues and are introducing risk-management measures, such as user data encryption and tokenization.

Another problem is the lack of a unified market - there’s a reason why we say “Europe and the UK”. Due to Brexit, European providers need to receive an additional UK license, and vice versa, rather than using the same open banking infrastructure.

User adoption is another drawback. People aren’t always ready to switch to a new technology, even in the tech-savvy UK. Most of the early open banking adopters are aged about 25-34 - young people with disposable income who are more eager to try innovative financial solutions.

This is changing, though. Even seniors, traditionally the most conservative part of the population, are changing their payment habits. For example, according to the Office for National Statistics, 52% of people in the UK aged 65-74 used the Internet in 2011, rising to 83% in 2019. And this figure is expected to grow in the coming years.

How do you choose an open banking provider for business?

A large deciding factor will depend on the location of your business. For example, if you only work in a single European country, you should choose a local payment provider that provides integration with local banks.

If you operate in several European countries, you need an international payment service provider that covers your whole customer base. Some providers can already give you access to thousands of European and British banks - just make sure they have the necessary licences.

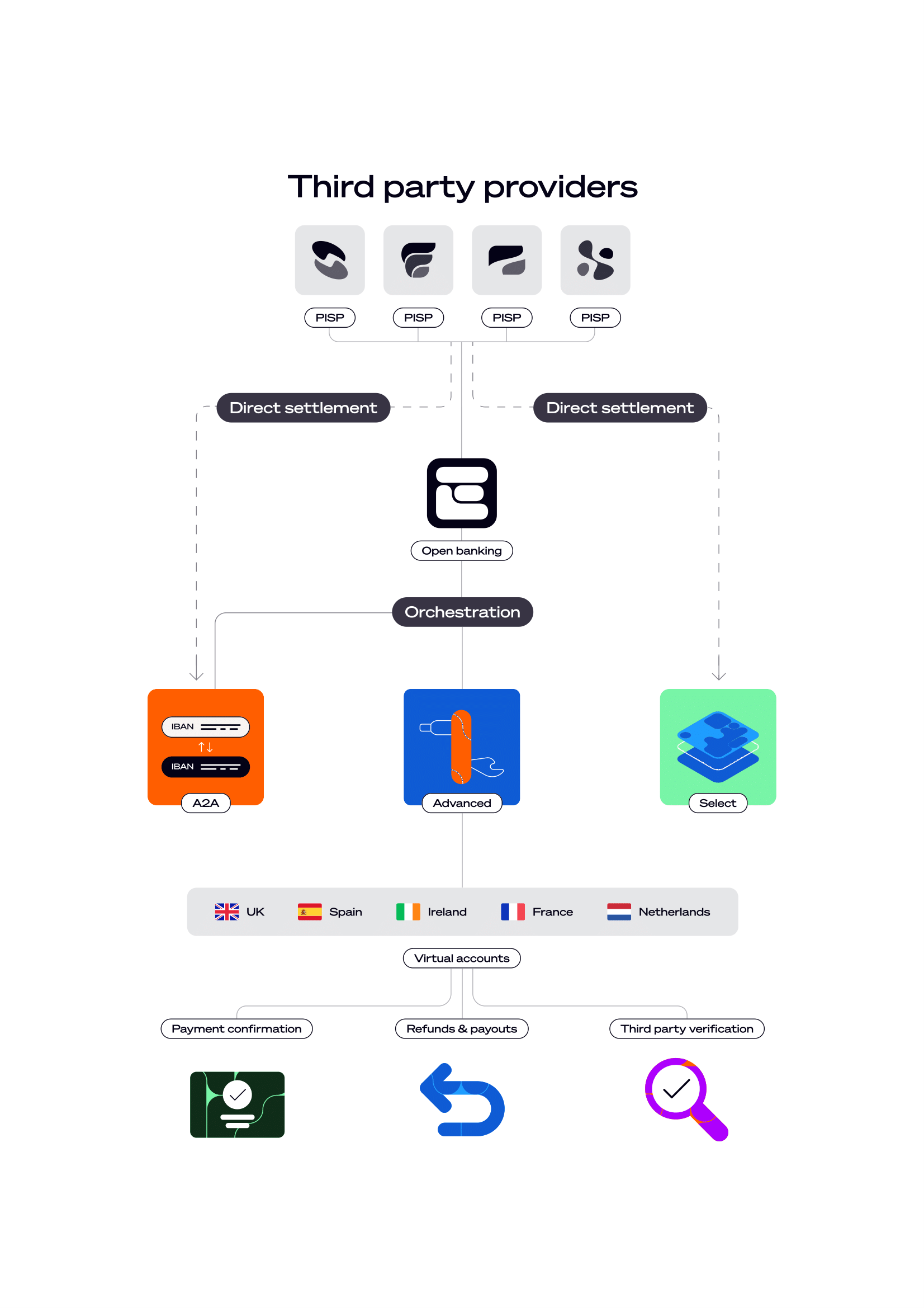

Introducing Open Banking Advanced by Ecommpay

Our open banking API allows you to connect with thousands of banks effortlessly anywhere in Europe. We’re constantly developing the product to offer the most convenient and reliable payment services for online businesses.

The latest adjustment features payouts and refunds via open banking, providing benefits to merchants like:

- Minimisation of bank charges.

- Maximisation of profits.

- Better control over funds.

How does it work?

Merchants accept payments via open banking for goods/services. Ecommpay, as a payment service provider, collects these funds on their behalf using a payment initiation service licence. If a customer requests a refund, it can be easily made via our merchant dashboard. In other cases, we collect the funds and make payouts at businesses’ requests. All a merchant needs to do is initiate the payout.

There are several benefits of this solution:

- A local bank account is not required to accept payments across Europe or in the UK - we collect all the funds for you.

- No manual refunds/payouts - everything can be done via our API/dashboard.

- Business expansion opportunities into Europe and the UK.

With our open banking payment solutions, you can connect to thousands of banks effortlessly anywhere in Europe.