Chargeback management: How to reduce revenue loss and minimise risks

Chargebacks can be costly for e-commerce merchants. Despite often being necessary to protect customers and maintain their trust, chargebacks typically incur a fee. When claims are submitted against valid purchases, the loss of revenue quickly adds up.

Access to effective chargeback management solutions is vital for all e-commerce merchants to strike a balance between safeguarding their consumers against fraud and protecting profit margins. In this comprehensive guide, we’ll share everything you need to know about managing chargebacks.

What is a chargeback, and how does it work?

Not to be confused with a refund or reversal, a chargeback is the payment amount returned to a customer’s debit or credit card after the customer’s issuing bank has disputed a transaction. The system was introduced by card schemes to protect the cardholders’ rights when making purchases with their bank cards, protecting them from fraudulent activity and poor quality services.

What is the chargeback management process?

Chargeback management is an umbrella term, referring to the tools, techniques, and strategies used to minimise the impact of chargebacks on a merchant’s business. It’s not about eradicating chargebacks to zero but addressing both dispute prevention and revenue recovery to keep the chargeback ratio within an acceptable range and helping merchants recover funds that may otherwise be lost due to the dispute process.

The three core pillars of an efficient chargeback management solution are proactive chargeback prevention, effective dispute management processes and tools, and data-driven analysis of the root cause of the claim to minimise the risk of recurrence.

How does the chargeback process work?

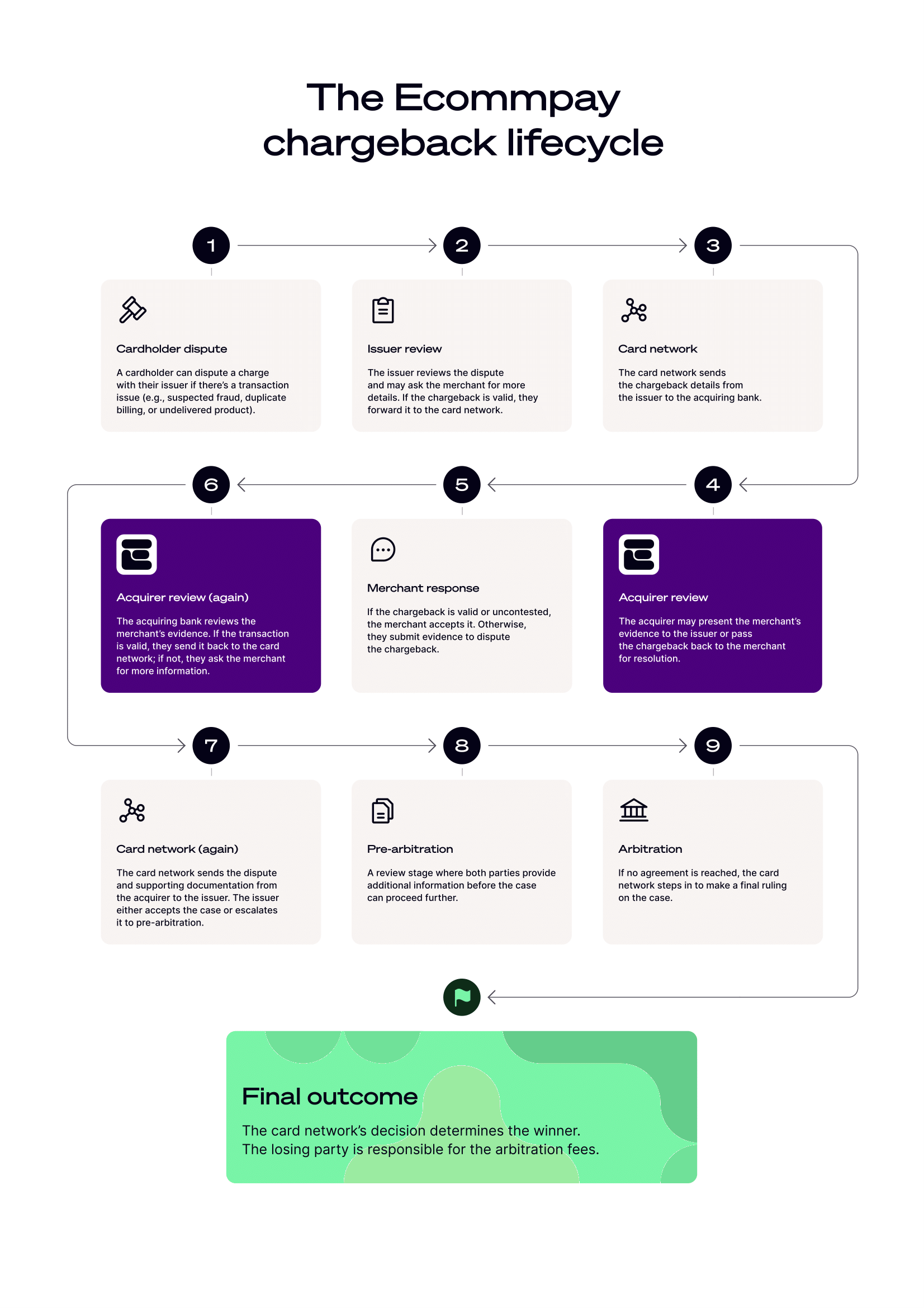

The chargeback process can feel overwhelming, but we have made it as straightforward as possible:

- A customer files a chargeback. They dispute a transaction with their bank or issuer.

- The merchant is notified. The payment provider alerts you as soon as the chargeback is initiated.

- You decide how to respond. You decide whether to accept the chargeback or challenge it (usually within four business days)

- We help you build a strong case. If you choose to dispute it, the payment provider will gather evidence on your behalf.

- The bank or card issuer reviews the dispute. Depending on the situation, it may go through multiple rounds before a final decision is made.

Why do merchants hate chargebacks?

When accepting card payments, merchants should be prepared to face chargebacks, even when that comes at a cost to the business. Through a chargeback, not only is the product and the revenue from its sale lost, but the acquiring bank will usually charge a fee, which can quickly escalate as more chargebacks are processed.

What actions can lead to chargebacks?

Customers can dispute any transactions they believe are invalid or feel they’ve not fully benefited from. Most chargebacks originate from one of three fundamental sources: product or service-related complaints, first-party (‘friendly’) fraud, and third-party (criminal) fraud.

In a time where third-party financial fraud is high, there are plenty of scenarios where chargebacks are well deserved by the customer. Card-Not-Present (CNP) fraud is common in online transactions, where unauthorised purchases are made using stolen card details. As there is no physical card presented for e-commerce purchases, CNP fraud can be difficult to detect. There’s no opportunity to examine the card for visual signs of fraud, such as incorrect details or a missing hologram, and the merchant cannot verify that it is a genuine cardholder who initiates and confirms the transaction.

Another type is Account Takeover (ATO), a form of identity theft where hackers access an account, posing as the account holder and making purchases using stored payment details.

Customers may also dispute a charge due to merchant or acquirer error, such as duplicate billing or providing unclear billing descriptors. If the customer cannot easily identify a purchase by its billing descriptor, they may believe the transaction to be fraudulent despite paying for and receiving the item. The customers’ concerns may also arise due to an issue with the provision or quality of the product or service itself.

In these instances, the fees associated with chargebacks are a loss that merchants must absorb.

With a plethora of reasons why a customer may dispute a purchase, having effective chargeback management solutions is vital for merchants to protect against invalid chargeback claims.

Common reasons for chargebacks

Before you can consider preventing chargebacks, it's first important to understand the various reasons behind why they happen. Here are a few of the most common scenarios:

Legitimate fraud

In essence, this is the reason why chargebacks exist in the first place. The idea behind them is to allow consumers to reverse transactions that are due to fraudulent activity, and legitimate fraud still constitutes a large portion of chargebacks.

Fraud is evolving, as are the tools used to combat it. According to the 2024 Chargeback Field Report, scammers are increasingly using AI-powered tools to carry out fraud, employing advanced techniques across email, voice and video, as well as the forgery of images and documents. In good news for merchants, AI is also being used for real-time detection, predictive analysis and behavioural analytics, helping merchants stop fraudsters in their tracks. With 72% of merchants reporting an increase in fraud, fraud prevention is more critical than ever.

Friendly fraud

This sounds so much nicer than it really is.

Friendly fraud is categorised as when a customer disputes a genuine transaction, either mistakenly or intentionally. This may be due to the customer forgetting that they made the purchase or their payment details may have unknowingly been used by a household member or friend. These disputes, although invalid, are often made without any malicious intent. Unfortunately, some instances of friendly fraud occur knowingly when a customer changes their mind about a purchase or tries to recuperate the funds without returning the item.

Cardholders are only supposed to dispute a charge for a limited number of reasons, but in reality, many people use it as a quick fix for everyday issues.

Chargebacks911 identifies friendly fraud as the leading cause of chargebacks, accounting for 45% of cases. Here are a few common examples:

- They don't recognise the charge

If someone looks at their credit card statement and sees a charge that they don't remember incurring, they might opt to dispute it and receive a chargeback. This could simply mean they made the purchase and forgot about it, or it could be that the name of the business wasn't clear on the card statement. - There are delivery problems

If an item never arrives or is taking longer than expected, the customer might assume that it's got lost and request a chargeback. If the customer was never given delivery details, they couldn't contact the business easily or they weren’t given a status of their order, this could lead them to dispute the charge. - They want to avoid the returns process

Often, chargebacks are used as an easy way to get out of processing a return. If a customer is unhappy with an item that they purchased, found the business's returns policy complex or difficult to understand, they could initiate a chargeback.

Poor customer service and communication

Customer service is often the first line of defense against chargebacks, and if customers feel heard and valued, they are less likely to file a dispute. If however you make it difficult for them to submit an enquiry or have an unclear refund process, they might consider a chargeback to be their best choices.

Allowing clerical mistakes

Avoiding merchant errors in bookkeeping may seem like obvious advice to you. However, many customer disputes are the result of simple clerical errors on the part of the merchant. If a customer was charged more than once or if they're still being billed for a cancelled subscription, they might file a dispute to rectify the errors. Simply double-checking all entries and auditing customer information multiple times could help strengthen your company and protect you from chargebacks.

Chargeback dispute management: Understanding chargeback disputes

Chargeback claims due to friendly fraud are out of the merchant’s hands - you can’t control whether or not a customer raises this type of claim. However, as the original purchase was legitimate, merchants can dispute chargebacks from friendly fraud.

If the merchant can provide sufficient evidence that the transaction was legitimate and that the product or service was provided in the agreed form and by the agreed date, a customer-initiated chargeback will be denied. However, chargeback management isn’t just about proving these claims wrong; an effective solution aims to pre-empt chargebacks through customer support and clear transaction details.

Chargeback management: Best practices for merchants

Prevention is always better than cure, and merchants can implement plenty of best practices to reduce the impact of chargebacks on the business.

A key starting point is to educate customer service and payment processing teams correctly on the nature of chargebacks and how to assist customers effectively. Implementing a proactive customer service strategy where customers receive prompt and effective support to resolve their issues can stop concerns from escalating into chargebacks.

Reduce potential misunderstandings by implementing clear returns policies, terms, and conditions. Keep this documentation transparent, digestible, and easy to find. It’s also vital to ensure that all transaction descriptors are easy to interpret. How the company and product appear on the customer’s bank statement can greatly impact chargeback rates, so make sure that descriptors are objectively clear.

Work with reliable delivery partners and regularly assess the effectiveness and efficiency of their service: a delivery partner should complete shipping within the expected time frame relayed to the customer at the point of purchase, as products delayed in transit can lead to chargeback claims.

If a chargeback claim makes it past these measures, having detailed records of transaction details, delivery confirmations, and any other communications can all act as evidence in a future chargeback dispute case. Support is available through chargeback mitigation solutions, which aim to gather evidence against friendly fraud or first-party misuse chargebacks to help recover merchant funds lost from these disputes.

It can be beneficial to partner with a trusted, PCI-compliant payment service provider to assist with chargeback management. Although chargebacks can be managed in-house, an external payment service provider will have access to certain chargeback management tools and solutions to prevent illegitimate chargeback claims and provide expert support to help manage disputes.

Ways to prevent chargebacks

The key is to be proactive, but even the most vigilant businesses can end up with some chargebacks. There are steps that you can take to minimise their frequency and here are a few key points to bear in mind:

- Prioritise security for credit card payments to avoid credit card chargebacks.

- Make returns as easy as possible.

- Manage delivery expectations.

- Be available to your customers.

- Make sure that your real company name is displayed on credit card statements.

Chargeback management tools and solutions

Stopping fraudsters in their tracks before illegitimate transactions are made is a key aspect of reducing chargebacks. Real-time monitoring tools, such as fraud detection and alerts, can highlight merchants of suspicious activity before it’s too late.

The best technique is a multi-layered approach to fraud detection, leveraging advanced technologies such as machine learning, behavioural analytics, and graph analysis coupled with manual fraud detection. When partnering with a payment service provider, take the time to explore their risk management offerings - look for cutting-edge approaches, in-depth monitoring processes, and leveraging of machine learning and artificial intelligence to mitigate fraud risks.

Identity verification solutions are an important measure in chargeback management, adding additional barriers to reduce the risk of CNP fraud and ATO. For example, merchants can:

- Request confirmation of the payment card’s CVV for every transaction, even when the card details are saved on the customer’s account

- Require two-factor authentication (2FA) at the point of purchase, requiring a one-time passcode sent directly to the account holder

- Implement biometric authentication for each transaction, requiring the customer to verify their identity through a fingerprint or facial recognition

Effective chargeback management

The best formula for chargeback management is a proactive, multi-step approach. The number of chargebacks a merchant receives can be drastically reduced by following strict rules and guidelines that reduce the chances of accidental friendly fraud claims, and having robust systems in place to protect against legitimate fraudulent transactions will lower the risk of chargeback claims while protecting both the merchant and its customers.

Merchants should assess their current systems and policies for managing chargebacks, and consider enlisting professional support for comprehensive chargeback protection. A payment service provider will understand the card issuer’s policies and the best way to tackle chargeback claims, resulting in a higher success rate, and lower costs for the merchant.

Simplify dispute management with Ecommpay

We all know chargebacks can be frustrating. You work hard to grow your business, make sales, and keep customers happy, and then a chargeback comes in, taking money right out of your account. Not only do you lose revenue but you also face the time-consuming process of handling the dispute.

The good news? You’re not alone.

At Ecommpay, we offer comprehensive chargeback management that not only guides you through the process, but also helps prevent disputes before they happen. With our award-winning risk control system and in-house expertise, you can confidently keep your business protected.

How can Ecommpay help with chargeback management?

Chargebacks aren’t just about losing money, they also come with extra fees and administrative work. That’s why it’s crucial to have a clear strategy for managing them.

With Ecommpay, chargeback management comes as standard. We don’t just help you respond to disputes - we help you prevent them in the first place.

Key features when you choose Ecommpay:

Advanced fraud prevention

Our award-winning risk control system helps catch potential chargebacks before they happen, keeping your business protected

Expert dispute handling

We manage chargeback responses in-house - no third parties, just dedicated experts working for you.

Custom strategies for every case

Every dispute is different. We provide tailored advice and evidence preparation to help you respond effectively.

Dealing with chargebacks isn’t anyone’s favourite part of doing business. But with our expert support, advanced risk management tools, and seamless dashboard integration - they don’t have to be a constant struggle. We will help you protect your business, reduce disputes, and streamline the entire process.