The most popular payment methods in Indonesia

With a population of more than 270 million people, and rising internet usage, Indonesia is one of the fastest growing e-commerce markets in Southeast Asia.

Indonesia's digital payments market is projected to exceed $117 billion by the end of 2025, establishing the country as a significant player in Asia's diverse payment ecosystem. In addition, revenue in the e-commerce market is forecast to reach nearly $60 billion in 2025. This growth offers considerable business opportunities for merchants operating in the region.

The payment landscape in Indonesia

What is the market size and projected growth rate of digital payments in Indonesia?

The digital payments market in Indonesia has experienced significant growth in recent years and is poised for continued expansion. Projections indicate that digital payments in Indonesia will grow by 15% in 2025 compared to the previous year.

Driven by the rapid adoption of mobile wallets and e-commerce, the total value of digital payments in Indonesia is expected to reach more than US$148 billion by 2028.

This expansion is supported by several factors, including increased smartphone penetration, government initiatives promoting cashless transactions, and a growing preference for online shopping among consumers. The rise of digital wallets and QR code-based payment systems has also played a significant role in enhancing the accessibility and convenience of digital payments across the country.

How many people in Indonesia are using digital payments?

As of 2024, the number of digital payment users in Indonesia is estimated to be approximately 144 million. According to a recent survey, 94% of Indonesian respondents have made a payment using an online payment method, with 78% using OVO.

What are the most popular digital wallets in Indonesia?

The most popular digital wallets in Indonesia are DOKU, OVO, and DANA, GoPay.

What opportunities exist for cross-border e-commerce in Indonesia?

Research revealed that 63% of Indonesian respondents have shopped cross-border, particularly in clothing and electronics.

Payment preferences in Indonesia

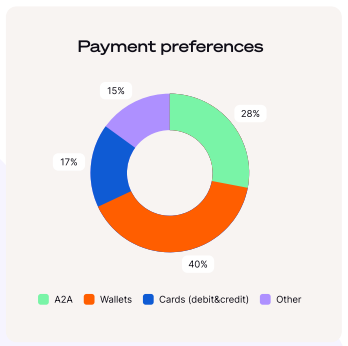

The preferred payment methods in Indonesia are digital wallets, A2A, cards, and other payment methods.

What are Indonesia's most popular alternative payment methods?

The most popular alternative payment methods (APMs) in Indonesia are digital wallets including DOKU, OVO and LinkAja.

ShopeePay, which is embedded within its e-commerce platform is another popular choice, and PayLater is used for Buy Now, Pay Later (BNPL) is used for almost 10% of purchases in Indonesia.

What payment methods does Ecommpay offer in Indonesia?

By leveraging Indonesia's range of alternative payment methods (APMs), you can reduce cart abandonment, improve conversions, and provide a seamless customer experience.

Ecommpay supports multiple payment methods in Indonesia, including digital wallets, QR code solutions, and bank transfers.

Virtual accounts

Virtual accounts have become a popular choice for online shopping and bill payments. Integrated with banks such as BCA and Mandiri, they provide secure and convenient transactions without requiring additional registration, making them ideal for both businesses and consumers.

DOKU

DOKU is a flexible e-wallet designed for individuals and businesses, particularly those in e-commerce and travel. It is a trusted payment solution for industries like airlines and tourism.

OVO

Favoured by younger, tech-savvy users, OVO is widely used for ride-hailing, food delivery, and online shopping. It serves as an essential tool for businesses aiming to reach urban, digital consumers.

QRIS

QRIS is a government initiative that unifies payment methods through a single QR code. It is extensively used by small businesses and street vendors, supporting Indonesia's shift towards a cashless society. Upon successful transaction completion, the customer's real name is shared with the merchant, adding an extra layer of security.

Bank transfer (payout)

Bank transfers remain a dependable option for large transactions, particularly among older consumers. Leading banks such as BRI and BNI dominate this space with secure and reliable payment services.

Ready to start exploring how offering Indonesian payment methods can help grow your business?

At Ecommpay, we are committed to supporting our customers in expanding their businesses into new markets. Our experts can advise on the payment methods you need to reach new customers in Indonesia.