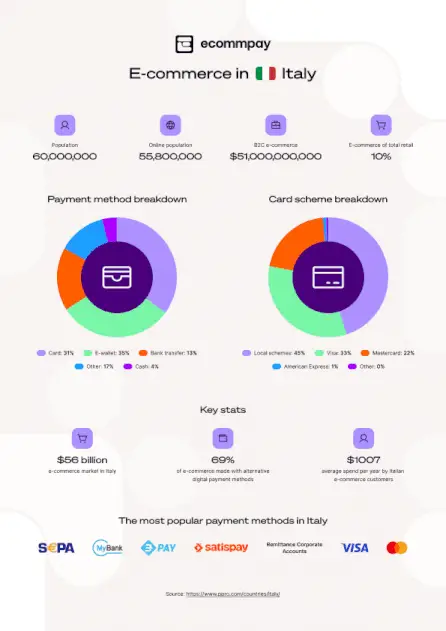

The most popular payment methods in Italy

Cash has long been king in Italy. However, e-commerce has been on a swift upward trend since the Covid-19 pandemic, with e-commerce payments revenue reaching $51 billion. As Alternative Payment Methods (APMs) gain traction alongside traditional payment options, the tides are well and truly turning.

For businesses already operating in Italy or those looking to expand into the region, offering the right APMs is key to capturing a piece of this growing market.

The payment landscape in Italy

What is the market size and projected growth rate of digital payments in Italy?

The Italian e-commerce market is worth $56 billion in 2025, and is expected to rise to $82 billion by 2027.

Cash remains a popular way to pay in Italy, but several factors are driving the swift growth of e-commerce in the region. For example, EU regulations have propelled the adoption of digital payments, like the Payment Services Directive 2 (PSD2), which has made online payments more secure and reduced fraud risks. This has increased the level of trust Italian consumers have towards digital payment methods.

Alongside this, digital payment systems in Italy are well-developed, and many digital wallets are easily accessible to Italian consumers, enabling easier adoption of e-commerce.

How many people in Italy are using digital payments?

As of 2025, 69% of Italians are using digital payments.

What are the most popular digital wallets in Italy?

The most popular digital wallets in Italy are PayPal, Skrill, Amazon Pay, and Google Pay. While Apple Pay is present in Italian e-commerce, this is used by a much smaller proportion of consumers compared to the aforementioned digital wallets.

What opportunities exist for cross-border e-commerce in Italy?

As e-commerce grows in popularity, the number of Italians shopping cross-border grows alongside it. By 2021, 75% of the population had purchased from international merchants, with China, Germany, and the UK being the most popular markets for cross-border e-commerce.

Payment preferences in Italy

The preferred payment methods in Italy are digital wallets, cards, other payment methods, bank transfers, and cash respectively.

What are Italy’s most popular Alternative Payment Methods?

The most popular Alternative Payment Methods in Italy are card and bank payments such as SEPA, MyBank, BANCOMAT Pay, and Remittance Corporate Accounts, card acquiring through Visa and Mastercard, and mobile payment options like Satispay.

While debit and credit card payments remain the most popular ways to pay for e-commerce purchases in Italy, the use of digital wallets is also gaining traction and should not be forgotten when crafting a payment strategy for the Italian market.

What APMs does Ecommpay offer in Italy?

Leveraging a variety of the most popular Alternative Payment Methods in Italy can help reduce cart abandonment and boost conversion when selling within the region.

Ecommpay supports multiple preferred Italian payment methods, best suited to e-commerce, retail, travel, FinTech, and online gaming businesses. Available through a single integration, you can save time launching new payment options and skip straight to capturing revenue.

Card acquiring

Accept payments from customers using debit cards, credit cards, or prepaid cards - the most popular method of payment for Italian e-commerce consumers.

Remittance Corporate Accounts

This solution allows businesses to pay their suppliers/partners to corporate bank accounts across the EEA and the UK.

Card and bank accounts

SEPA OUT: Perform payouts to EUR bank accounts. This APM is ideal for Italian merchants who need to send payments to customers, suppliers, or partners across the EU.

SEPA Direct Debit: A low-cost and efficient way to handle subscription and recurring payments while giving customers the convenience of automated payments.

MyBank

MyBank is an especially popular payment method in Italy that offers a safe and simple way for consumers to pay for their online purchases using real-time bank transfers.

BANCOMAT Pay

Available to all PagoBANCOMAT® cardholders via their bank's app or the BANCOMAT Pay app. This APM is connected directly to the customer’s bank account by phone number and IBAN, providing services like peer-to-peer, money transfers, and in-store payments.

Consumers simply enter their mobile number at checkout and confirm the payment through the app by PIN, fingerprint, or face recognition.

Satispay

Satispay leads the mobile payments market in Italy. Users can join using their mobile numbers and simply connect their bank accounts for convenient payments.

Ready to start exploring how offering Italian payment methods can help grow your business?

At Ecommpay, we are committed to supporting our merchants in expanding their businesses into new markets. Ready to conquer the world of Italian e-commerce? Chat with our payments experts to determine the best Italian APMs to help your business reach its target consumers.