Remember: All data presented must comply with applicable data protection and privacy laws. Users are responsible for ensuring that payment data is processed lawfully and securely. .

What is a payment dashboard & how can SMEs benefit from it?

For many small and medium-sized enterprises (SMEs), managing payments isn’t just about getting paid - it’s about keeping operations running smoothly, staying on top of cash flow, and having clear visibility into every transaction. But without the right tools, making sense of payment data can be a real challenge.

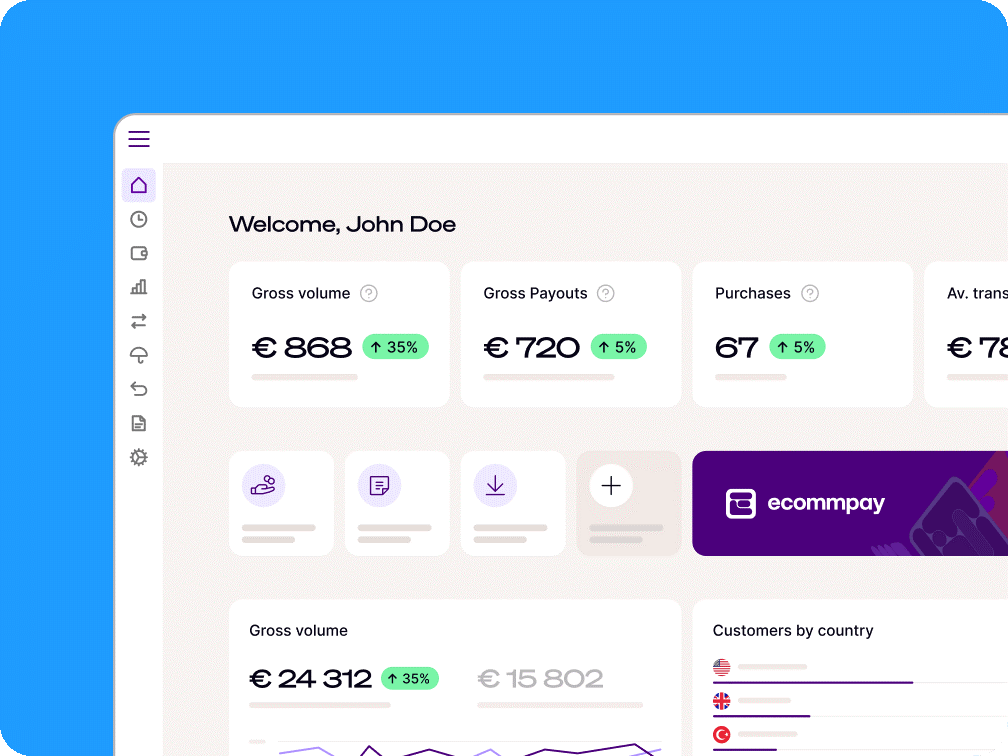

That’s where a payment dashboard makes a difference. Think of it as your payments control centre: a real-time, centralised view of your payment operations. The right tools don’t just organise data, they transform raw numbers into meaningful insights, enabling better decision-making, greater operational agility, and measurable performance improvements.

In this post, we’ll break down what a payment dashboard actually does, and how it can help small businesses save time, may improve cash flow, and potentially make smarter decisions.

1. Get real-time visibility into your transactions

Waiting days to reconcile bank statements or track down payments is more than just a hassle, it can slow down your entire business. A payment dashboard gives you a live view of incoming and outgoing payments, broken down by method, currency, or channel.

How SMEs benefit:

- See which transactions have settled, failed, or are still pending.

- Spot unusual patterns or payment issues quickly.

- Track performance by product, region, or customer segment.

2. Stay on top of cash flow

Healthy cash flow is critical, but for many SMEs, managing it means juggling spreadsheets, PDFs, and manually chasing payments. A payment dashboard brings all your financial activity into one place, so you know exactly what’s coming in, what’s going out, and when.

How SMEs benefit:

- Predict when funds will hit your account.

- Plan for supplier payments and payroll with more confidence.

- Get alerts when settlement times are delayed.

3. Track KPIs that actually matter

Beyond seeing payments in and out, the best dashboards let you monitor key payment metrics - like conversion rates, approval rates, chargebacks, and refunds.

How SMEs benefit:

- Identify which payment methods convert best.

- Track how often payments fail and why.

- Monitor refund rates to spot product or service issues.

4. Reduce admin overload

Manual reconciliation, logging into multiple payment provider accounts, and sifting through statements all add up to hours lost each week. With a unified dashboard, your finance and operations teams have everything in one place.

How SMEs benefit:

- Save time with automated reporting and data exports.

- Quickly pull info for accountants, audits, or investor updates.

- Reduce errors from manual data entry.

5. Spot fraud and disputes faster

Chargebacks and fraud can eat into your margins if they go unnoticed. A good payment dashboard shows chargeback trends and flags unusual activity early.

How SMEs benefit:

- Get real-time alerts to help identify potential suspicious transactions.

- Easily access supporting documentation for disputes.

- Track dispute resolution statuses in one place.

You’ll be better equipped to protect your revenue—and your reputation.

6. Make smarter decisions as you grow

As your business scales, so does the complexity of your payment operations. A payment dashboard helps you make data-backed decisions—whether that’s expanding to new markets, adding payment options, or negotiating better rates with providers.

How SMEs benefit:

- Compare performance across payment channels.

- Forecast revenue from specific customer groups or products.

- Understand which markets are most profitable.

Growth becomes strategic, not just reactive.

Final thoughts

A payment dashboard might sound like a “nice to have,” but for SMEs trying to stay efficient, compliant, and competitive, it’s quickly becoming a necessity.

With the right dashboard in place, you can stay in control of your finances, spot issues early, and scale your business with confidence.