Customer stories

Payments that power all sorts of businesses

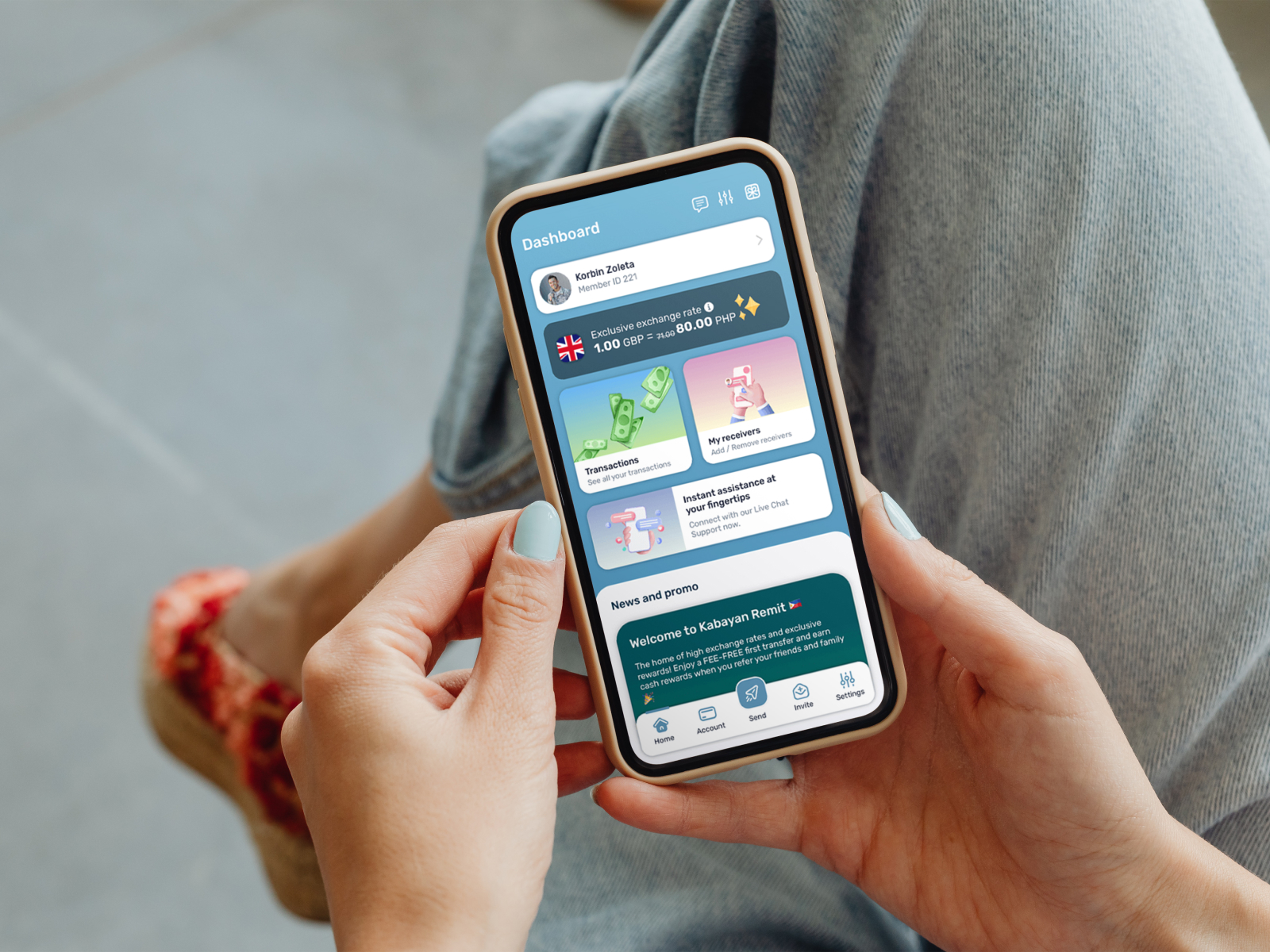

FinTech

Remitting success: how Ecommpay helped Kabayan Remit scale up and streamline payments

Helping Kabayan Remit scale fast, Ecommpay streamlined their payments to support smooth growth and better customer experience.

Travel & Hospitality

Galaxy Travel navigates growth with Ecommpay

With a mission to deliver memorable journeys at every touchpoint, Galaxy Travel Ltd needed a payments partner that was ready to support their rapid growth

Retail

Fuelling smarter builds: How Building Materials powered growth with Ecommpay

By teaming up with Ecommpay, Building Material Ltd made it easier for UK tradespeople to get what they need - fast, simple, and built for growth.

FinTech

Driving faster, smarter payments: How HiQi fuelled growth with Ecommpay

HiQi, the innovative Portuguese app transforming how drivers pay for fuel, partnered with Ecommpay to revolutionise its top-up process.

Travel & Hospitality

Travelopedia Ltd’s journey to seamless payments

Focused on helping people travel the globe, Travelopedia Ltd needed a payments partner to support seamless growth and customer trust.

Retail

Payments that support the Swytch to more sustainable transportation

With a mission to make electric transport accessible to everyone, Swytch needed a payments partner that could support the business’s rapid evolution.

This page is being updated. Please check our LinkedIn page for latest news.