Remitting success: How Ecommpay helped Kabayan scale up and streamline payments

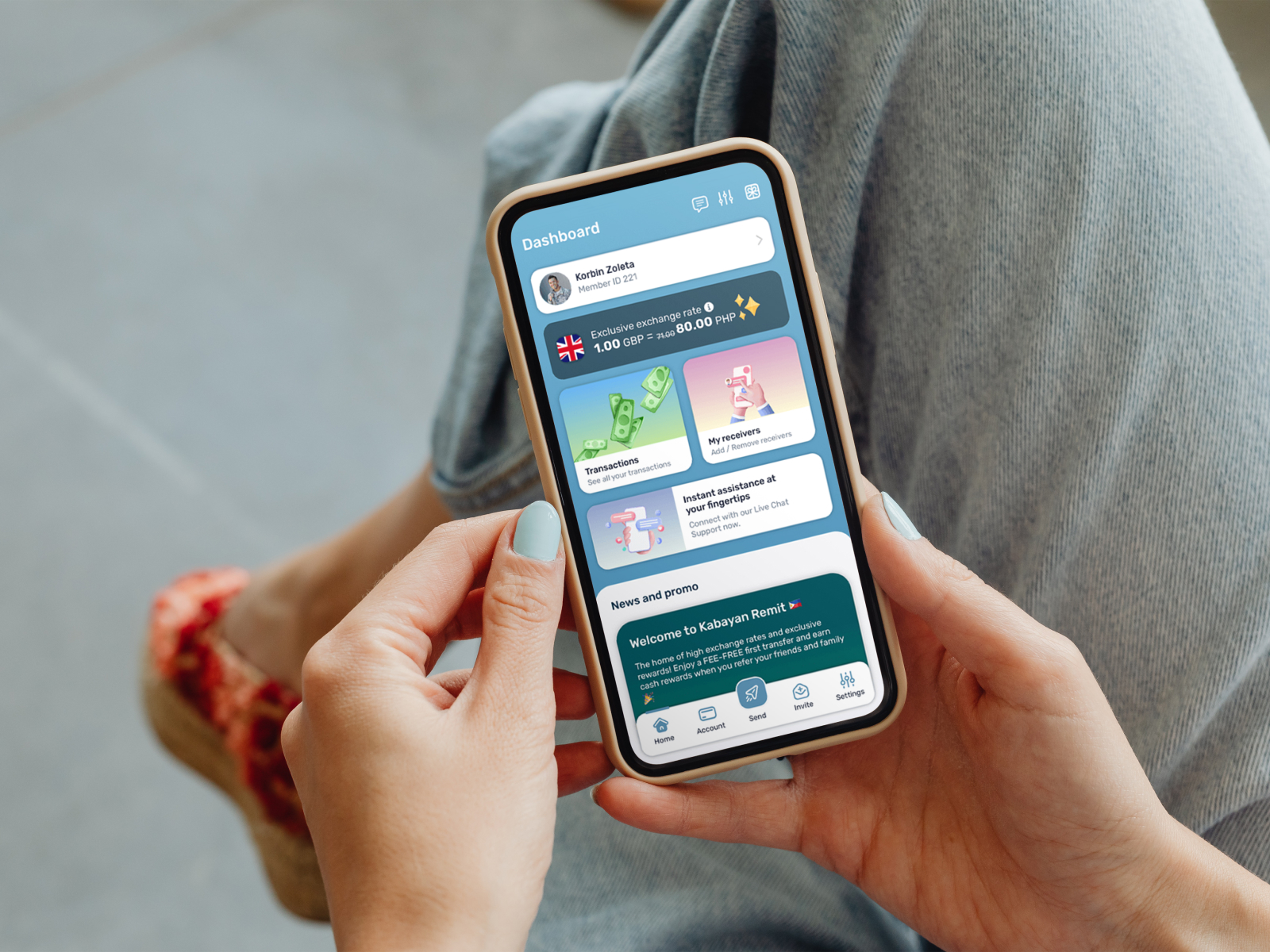

Kabayan Remit is on a mission: to make it easier, faster, and more affordable for the Filipino community in the UK, US, and Canada to send money back home. As a digital-first remittance company, everything they do is centred around speed, trust, and convenience for their users.

But as the business grew, they started to run into some all too familiar problems - high payment processing fees, clunky tech, and slow, impersonal support. They needed a payments partner who could keep up with their pace, work closely with their team, and help them scale without the stress. That’s where Ecommpay came in.

The Kabayan Remit approach

Like many growing fintech businesses, Kabayan Remit had outgrown their existing payment provider. They were dealing with high card processing fees, slow support response times, and very little flexibility. Whenever a payment issue popped up, it took too long to resolve, and that was affecting customers.

Worse still, the setup just wasn’t built for a business that needed to move fast. Adapting to new demands or launching new features felt like a struggle. And for a company with ambitious growth plans, those limitations weren’t sustainable.

The Ecommpay approach

From the first conversations, Kabayan Remit saw that Ecommpay worked differently. The team took the time to understand the challenges, offered a clear and cost-effective solution, and promised something big providers couldn’t - real, hands-on support.

Ecommpay introduced a flexible setup that included both traditional card payments and open banking, giving Kabayan Remit the best of both worlds. The open banking option has been a standout, with customers loving the speed and simplicity. And with faster payment confirmations and fewer errors, the entire payment flow has become smoother and more reliable.

Integration was refreshingly easy. With well-documented APIs and a technical team that was always just a message away, the rollout went off without a hitch. And whenever a question came up, Ecommpay’s support team responded quickly with helpful, actionable guidance, no waiting around.

Since going live, the impact has been clear. Over 10% of their users now choose the open banking option, which has helped reduce checkout abandonment and improve customer satisfaction.

What's next?

For Kabayan Remit, this isn’t just about solving old problems, it’s about building the kind of infrastructure that can support long-term growth. With Ecommpay in place, they now have the freedom to scale, launch in new markets, and keep improving the customer journey without worrying that their payments system will hold them back.

As Kabayan Remit looks ahead, Ecommpay will continue to play a key role in helping them grow, not just as a provider, but as a true payments partner.