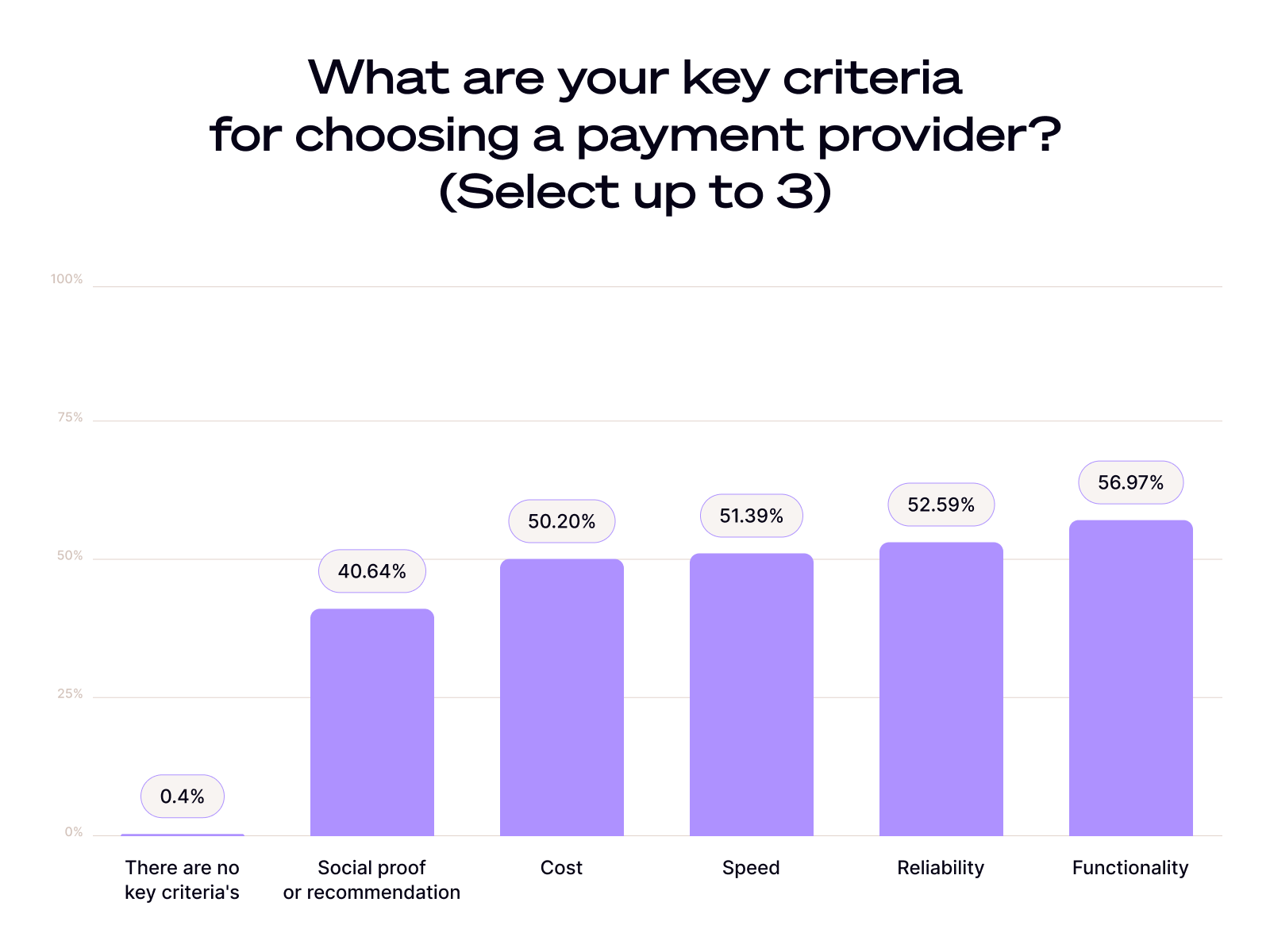

Merchants focus on functionality, reliability and speed of payment providers

Research from inclusive payments platform, Ecommpay, has found that merchants place more value on the practical elements of a payment provision than on a personal recommendation or even cost. Over half (57%) of merchant respondents selected ‘functionality’ as one of their top three criteria when choosing a payment provider. This was followed by 53% choosing ‘reliability’ and 51% ‘speed’. Half chose ‘cost’, while just 41% rated social proof or recommendation as a deciding factor.

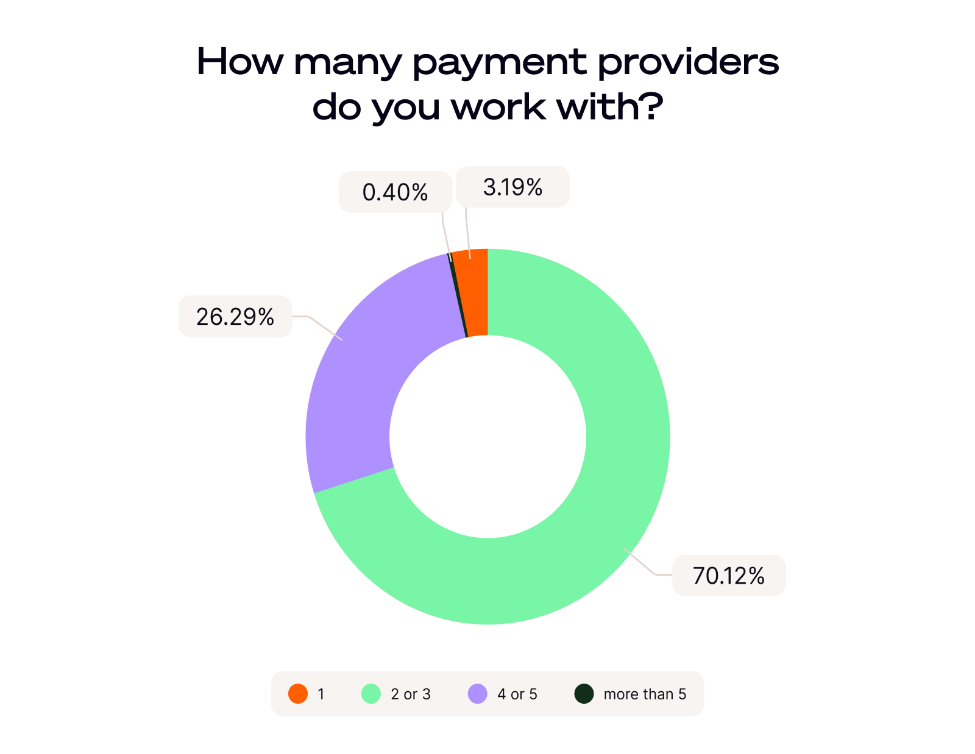

The survey also found that the average merchant business uses three payment providers, although a quarter work with four or five different providers to meet all their needs.

A separate Ecommpay report - eCommerce Checkouts: UK Retailers Reveal Their Checkout Strategy and Performance - published in partnership with IMRG, found that the average e-commerce conversion rate is just 58% and most drop-offs occur in the latest stages of checkout, demonstrating that there is much room for improvement in payment processes.

“To maximise sales and reduce drop-offs during checkout, merchants need to deliver a seamless, reliable checkout journey from start to finish,” commented Moshe Winegarten, Chief Revenue Officer of Ecommpay.

“Arguably the most important section of a customer checkout is the payment page, as this is where most drop-offs seem to occur. Therefore, merchants should choose their payment partners carefully, with a focus on tech capabilities and agility to deliver the best conversion performance.”

The Ecommpay report - eCommerce Checkouts: UK Retailers Reveal Their Checkout Strategy and Performance - revealed that credit and debit cards account for half of all revenue, while the rest is split across a range of alternative payment methods and conversion rates are higher where more Express Checkout options are available. Another critical issue was that only half of retailers offer localised payment options which could increase cross-border sales. With the right functionality in place, merchants can offer a wide range of alternative payment methods, Express Checkout and international payment options.

Moshe Winegarten continued: “At Ecommpay we are committed to driving financial inclusion, enhancing local payment experiences and providing merchants with the best possible payment solutions. To do this effectively, we utilise the latest and most innovative tech. Importantly, we always focus on delivering tech that will fill gaps and broaden the range of payment solutions available to merchants and their customers. As such, we are helping e-commerce businesses improve the user experience and boost conversions and loyalty via smooth payment journeys.”